The landscape of urban living is changing and expanding. Adina David, director of urban living at Greystar, the global investor, developer and manager of rental properties, points to the rise of four key trends as the catalyst: the single-person household, the sharing economy, loneliness & social isolation, and a more mobile younger generation.

Housing is no longer just about where residents live, but also about how they want to live. Residential specialists such as Greystar do not only develop and acquire assets, but also take charge of designing the individual units and shared spaces, and building the community engagement.

Adina David, director of urban living at Greystar, has identified four key trends.

This comes at a time when the pace of urbanisation continues to rise, with 84% of people in Europe expected to live in urban areas by 2050. “In today’s globally integrated, services-based economy, businesses want to be located where capital – both human and financial – is concentrated,” writes PATRIZIA in a recent report on housing.

The German-based investment manager, with offices around the world, identifies London, Paris and Vienna as the top three most attractive cities for residential investors in its latest European City Living Index. The top three ‘movers’ up the ranking are Uppsala (Sweden), Coventry (UK) and Regensburg (Germany).

Record levels of investment are flow into housing

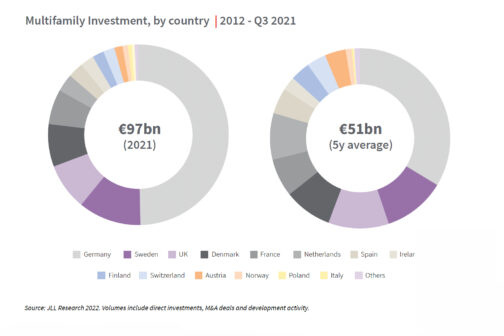

These quite seismic shifts in urban living come at a time when multi-family investment has become mainstream for many international real estate investors, says JLL in its report, Multifamily: A sector coming of age.

“We can look back on 2021 as the year in which multi-family investment became mainstream for many international real estate investors” – Gemma Kendall, JLL

Total annual compound growth in multi-family investment across Europe was at over 15% between 2021 and 2020. Then in 2021 this figure shot up by 50% to reach €97bn, with cross-border investors accounting for around a third of total investment.

“We can look back on 2021 as the year in which multifamily investment became mainstream for many international real estate investors,” writes Gemma Kendall, head of multifamily investment – EMEA, at JLL, in the report.

The two key transactions that led to last year’s surge were the takeover of Deutsche Wohnen by Vonovia in Germany to create Europe’s largest residential real estate group; and the purchase by Heimstaden Bostad of a German/Scandinavian portfolio from Akelius for €9.1bn.

2022 is only set to build on that “strength” in the multi-family investment market, with new international players likely to form joint ventures with established local players, adds Kendall, while “some more traditional residential investors are set to turn to alternative locations to create new investment hotspots”.

Gemma Kendall, head of multifamily investment – EMEA at JLL

PATRIZIA launched its pan-European flagship fund, Living Cities Residential Fund in 2019, of which 20% is invested in the ‘living’ category, including co-living, retirement and student housing.

The fund, which is for institutional investors, is looking to reach at least €2bn of assets by the end of 2022, with properties already acquired in Denmark, Finland, Ireland, Spain, Sweden and the UK. The latest acquisition is of a €600mn portfolio in Barcelona.

Nathalie Winkelmann, Living Cities fund director & head of residential fund management at PATRIZIA

“At the end of Q3 2021 we achieved 10.7 % total return year over year for our clients, so we are on track to beat our own annual target of between 6 and 7 percent return for our fund,” said Nathalie Winkelmann, Living Cities fund director & head of residential fund management at PATRIZIA.

Greystar recognises the rise of the single renter

Since opening its first European office in London in 2013, Greystar has built up a portfolio of 30,000 residential apartments and student beds across Austria, France, Germany, Ireland, the Netherlands, Spain and the UK.

The global investor, developer and manager of rental properties says it has further rapid growth planned, following the launch of its new pan-European value-add strategy and several develop-to-core ventures with institutional investors in key cities.

In Europe, a key focus for Greystar is urban living and the single renter. “We look to build housing that enables single renters to live on their own, more affordably, and to connect with neighbours, so that they are not living in isolation,” explains David.

“We look to build housing that enables single renters to live on their own, more affordably, and to connect with neighbours” – Adina David, Greystar

The Greystar model for single renter housing varies from market to market in Europe, depending on local building standards and planning regulations. However, “all slated projects include shared living amenities and an active ground floor open to the wider neighbourhood, all designed for long-term community building”, says David.

Greystar recently announced a new £2.2bn strategic partnership with the Abu Dhabi Investment Authority (ADIA) which it is looking to deploy for urban sites, following on from the success of the partnership in the Dutch market with student and young professional accommodation brand OurDomain.

The communal space, OurDomain in Amsterdam

PubblikVos

In London, last June, Greystar announced the acquisition of a new site in Battersea. Subject to planning, it is designed to offer 547 self-contained studio units together with shared living amenities.

“The idea is that you may sleep in your studio or one-bed apartment but choose to ‘live’ in your communal space” – Adina David, Greystar

At the Battersea project, the studio units are on average 26m2 and include a kitchenette and bathroom. Planned for the shared amenities is a coffee shop, a co-working space, fitness centre, and a cycling hub and workshop. “The idea is that you may sleep in your studio or one-bed apartment but choose to ‘live’ in your communal space,” says David.

Greystar sees most of the demand for single renter accommodation coming from young professionals. However, the average age of a Greystar urban living resident in Europe is 30, given that their projects also welcome residents from different life stages, often looking for a bridge to some other form of accommodation.

“The whole premise of the product is that it is very easy to move in,” says David. “The space is fully furnished, and the rent is comparable to the local studio and one-bed market but more attainable as all bills are inclusive.”

In short, says David, “it is about looking to improve the quality of living for single renters in large cities.” And, as Greystar expands the amount of co-working space on offer, with the rise of hybrid working, going to the office in the morning is as easy as catching the lift.

Credit for main image of Greystar’s OurDomain in Amsterdam: ãPubblikVos

You can hear Adina David of Greystar talk at MIPIM 2022 on the panel session ‘A second wind for housing’ on Thursday 17 March. Housing First is one of the key topics at MIPIM this year.

PATRIZIA AG is a sponsor of the MIPIM Re-Invest Summit (by invitation only).

You may also be interested in ‘A redesign of how we experience senior living’ and in ‘Housing: the opportunity for collaboration and public-private partnership’ by Alex Notay of PfP Capital – one of 5 insights shared ahead of MIPIM 2022.