One thing is certain … people have a desire “to enjoy, to travel, to stay in nice places and to celebrate”, said Maud Bailly (below), CEO for Southern Europe of Accor, Europe’s biggest hotel group, at last month’s Leaders’ Perspectives Summit by MIPIM.

When it comes to the uncertainty created by the health crisis, we all know the figures: travel & tourism GDP dropped by a staggering 49.1% globally, compared with 3.7% for the overall global economy in 2020, according to the World Travel & Tourism Council.

As vaccine programmes are rolled out, and spirits rise in advance of the summer season in Europe, hotel operators, while still managing the ongoing health crisis, have also turned their attention to rebuilding for recovery.

When it comes to the investment market, potential buyers are playing a waiting game; for the right product at the right price, with many confident of the long-term health of the sector.

© Sotogrande SA SO/ Sotogrande, an Accor lifestyle hotel, is due to open in southern Spain this July.

Extra capital for hotel investment in Europe

The average RevPAR (revenue per available room) for hotels across Europe fell by 62.5% in 2020, according to data analyst STR.

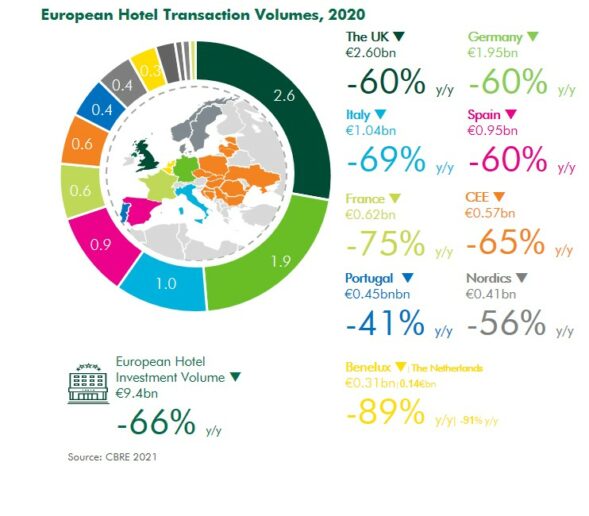

The hotel investment market also took a nose dive across the region, with transactions down 66% over the year to €9.4bn, says CBRE in its EMEA Hotels Market Update 2021.

MIPIM World spoke with Jan Steinebach, senior director, EMEA Hotels, CBRE, about his perspectives on the investment market.

“There is still a wide range of investors wishing to invest in the sector,” says Steinebach, who adds that investors had raised significant additional capital in 2020 to specifically target hotel opportunities.

Some investors had divested many of their hotel interests pre-2019 and have been waiting on the sidelines – Jan Steinebach, CBRE

“What we have seen over the pandemic is that some new entrants, mainly private equity, are looking to enter the market as they see the opportunity to buy good quality assets at a discount, or acquire hotels that would otherwise be unavailable. Some of these investors had divested many of their hotel interests pre-2019 and have been waiting on the sidelines, even before the pandemic.

“Long-term investors are ready to enter the market and to remain, given that their models can handle potential market fluctuations.

Future leases will change permanently as they will likely have more performance-related terms and clauses as a result of the pandemic – Jan Steinebach, CBRE

“We are also seeing interest in acquiring operating businesses, either with attached real estate or without.

“Buyers see the potential to scale up platforms and to take advantage of opportunities where the existing operator is in distress. Some of these opcos are still able to offer a lease, albeit 100% variable in many instances, indicating long-term confidence in the sector.

“Future leases will change permanently as they will likely have more performance-related terms and clauses as a result of the Covid-19 pandemic.

“Many investors are seeing this as an opportunity to purchase prime assets that rarely come to the market as they provide long-term income generation and have held their values somewhat throughout this challenging period.”

Tristan takes a long-term strategy

“Tristan decided to actively pursue deals in the hotel space prior to the pandemic,” says Luc Boschmans, who joined Tristan Capital Partners earlier this year as managing director for hospitality.

We are looking to capitalise on the positive underlying trends seen in the sector before the pandemic – Luc Boschmans, Tristan

“While we are seeing some short-term distressed opportunities, our more strategic approach means we are looking to capitalise on the positive underlying trends seen in the sector before the pandemic.

We see the hospitality sector as a long-term strategy for Tristan – Luc Boschmans, Tristan

“As such, we see the hospitality sector as a long-term strategy for Tristan, and so, while we are currently focusing investments on Western and Southern Europe, we will look at countries on an opportunistic basis, with future growth dependent on market fundamentals including locations, asset class, and operators.

Luc Boschman, Tristan Capital Partners

“For instance, many resort destinations could indeed benefit from returning leisure demand later this year, while business and long-haul travel could take considerably longer to recover, impacting hotels focused on international clientele or strong corporate demand.”

Schroders fund looking to buy a “dozen properties across Europe”

Global investment manager Schroders announced last July that it had raised €425m of equity commitments for its debut hotel fund, the Schroder European Operating Hotels Fund 1.

The fund’s aim is to create a high-quality diversified portfolio of hotels across some of Western Europe’s top business and leisure destinations.

Frederic de Brem, head of Schroder Real Estate Hotels, told MIPIM World: “We would like to buy a dozen properties across Europe. We’ve made a few offers since the start of the year, but so far we have not committed to any deals; and, in a few cases, discussions are progressing.”

Frederic de Brem, Schroder Real Estate Hotels

When it comes to the effect of the health crisis, De Brem says that the relationship between tenants and landlords in the sector is morphing: “Landlords must contribute to the operating pain to support their tenants. More variable rent is on the table and will probably happen across the coming years.”

We’ve made a few offers since the start of the year, but so far we have not committed to any deals; and, in a few cases, discussions are progressing – Frederic de Brem, Schroder Real Estate Hotels

With regards to the recovery of the sector: “Historically, city centre hotels have performed better, and traded at a premium, but their bounceback will probably be slower in the coming years, with hotels targeting a regional clientele likely to rebound faster.”

How hotels are resetting: Accor – Europe’s leader

“Once upon a time there was a blessed industry which was hospitality,” said Maud Bailly, CEO for Southern Europe of Accor, at the opening of her presentation at the Leaders’ Perspectives Summit by MIPIM this March.

“We were really confident that 2020 was going to be an amazing year. No one could have have predicted a drop of 1.1bn international travellers,” said Bailly.

© Martin Goddard

Mondrian Shoreditch, London, due to open in 2021. The Accor hotel will include a rooftop Rumpus Room, a restaurant by Michelin-starred chef Dani García, and The Curtain Members’ Club.

The focus at Accor – which has over 5,100 hotels in 110 countries – is now on preparing for the rebounce. “We need to be ready and to anticipate,” said Bailly. Currently some 85% of Accor hotels worldwide are open.

- First off is a focus on cleanliness and prevention, through the new Accor ALLSAFE label, developed with Bureau Veritas, and which has around 100 standards. “Strict sanitation and hotel policies play the largest role in choosing where people want to stay,” says an Accor customer survey carried out during the health crisis.

- Next comes adapting to guests’ expectations of flexibility. No change and no cancellation fees emerged as the second and third most important factors in the survey. “Before the crisis 50% of clients booked their stay ten days before beginning their travel, today 50% are booking two days before,” said Bailly.

- Flexibility in services also comes in the form of the new Accor Key app, providing guests with a keyless door entry solution. It’s about adopting technology – in this case through a partnership with STAYmyway – to improve the guest experience, says Accor, which is opening its first fully digital hotel in Northern Europe with the Ibis Styles London Gloucester Road.

- And it’s about flexibility of space, by integrating smart, flexible workspaces and services through its Workspitality® solutions, which include accelerating the development of the Wojo brand, a joint venture with Bouygues Immobilier, through opening Wojo Spots and Wojo Corners in Accor hotels.

- Another development is the strengthening of Accor’s branded residences, private rentals and extended-stay hotels, in response to increased demand from guests, with the launch of the Apartments & Villas website, which lists over 50,000 properties. Accor currently operates 30 branded residence projects globally, with another 70 in development.

A growing focus on lifestyle hotels

Accor plans to boost its lifestyle operations to account for over 25% of fees, from a current base of 5%, as the number of Accor’s lifestyle hotels triples by 2023.

For Accor, the lifestyle concept is about turning hotels into neighbourhood destinations, with non-staying guests having the option to ‘subscribe’ to the hotel’s amenities.

At the end of last year, London-based hospitality group Ennismore merged with Accor to set up a new lifestyle entity, under the retained Ennismore name.

The new entity groups 12 brands: The Hoxton, Gleneagles, Delano, SLS, Mondrian, SO/ Hotels & Resorts, Hyde, 25hours, 21c Museum Hotels, TRIBE, Jo&JOE and Working From_ (a co-working space by The Hoxton). It includes an in-house global creative studio; a digital and technology team innovating the guest experience; and a team of restaurant and bar specialists crafting unique concepts rooted in their neighbourhoods.

The Hoxton Los Angeles opened in downtown LA in 2019: it’s all about lifestyle

The lifestyle concept is about catering for 90% a guest’s needs; not only through the subscription model, but also through the global Accor Live Limitless loyalty programme, launched in 2019, and which operates together with a network of partners, including Air France/KLM and Paris Saint-Germain Football Club.

We see a huge interest of people still willing to invest in the hospitality industry because, to cut a long story short, they trust it – Maud Bailly, Accor

Meanwhile, Accor’s development pipeline is still very dynamic. In Southern Europe, the group is opening one hotel every four days this year, across all categories, including Mama Shelter in Rome in May and SO/ Sotogrande in Spain in July, while next year Maison Delano is due to open in Paris’ 8th district.

Accor is opening one hotel every four days in Southern Europe in 2021, including SO/ Sotogrande ©Sotogrande SA

“We see a huge interest of people still willing to invest in the hospitality industry because, to cut a long story short, they trust it,” said Bailly at the Leaders’ Perspective Summit by MIPIM.

“People will want to travel again, to have fun again, and to discover a new culture, a new country,” she added. And, boy, do we know that feeling.

Main picture: SLS Dubai Hotel & Residences, where the two infinity pools at the top of the 75-storey tower offer a 360-degree view of Dubai. SLS is renowned for its “sophistication with a playful wit”, says Accor. With 7 hotels already in the network, a further 11 are in the pipeline.