The co-organiser of the first ever MIPIM Co-Liv Summit went on a world tour with a difference the year before Covid struck: he visited 80 co-living properties and talked with over 200 operators to then write the book Art of Coliving.

Co-living is a loose term. Broadly it’s about “living together with people you’re not related to, under one roof, and sharing the basic amenities”, says Gui Perdrix, who, back from his travels, went on to become director of Co-Liv, the world’s largest non-profit association of co-living professionals.

"Making an impact"- White paper

Successful impact investing in real estate

Julia Martin, head of student housing & co-living, EMEA international capital markets, at global real estate advisor JLL, sees the term emerging from the professionalisation of the ‘flexible living’ market. Co-living, she says, fits neatly between student accommodation and single-family housing in the lifecycle of people’s housing needs.

A significant number of more classic institutions and insurance companies are now looking at the co-living sector – Julia Martin, JLL

A co-living property can range from a refurbished family house shared by 12 residents to a new build in the city centre with hundreds of units. The concept includes amenities and services, ranging from basic to luxury, and community-building social activities. When it comes to planning, the class into which co-living falls depends on the jurisdiction.

At the first MIPIM Co-Liv Summit, which takes place in Cannes on Monday 13 March, some 300 people from across the sector will gather to network, discuss opportunities and be inspired.

The 20 speakers include keynote Luca Bovone, founder & CEO of Habyt, which this January became the largest global co-living operator, following its merger with Common.

The shared space at a Common property in Washington DC, the US

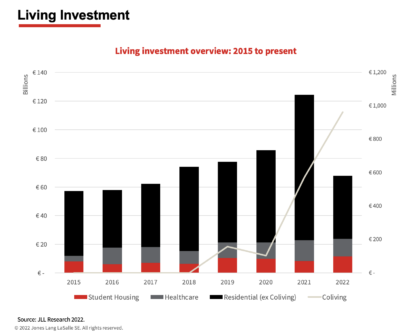

Investment in co-living across Europe is on an “exponential rise”

“Co-living is a nascent market for investors,” says Julia Martin of JLL, which last year published The European Co-Living Best Practice Guide in partnership with the Urban Land Institute.

“The investment curve is on an exponential rise,” she explains. The co-living sector received €963mn of investment in 2022, over half of the total investment (€1.8bn) received since 2015 and 2021, according to JLL.

Julia Martin of JLL: working in a nascent investment market

“A significant number of more classic institutions and insurance companies are now looking at the co-living sector. They haven’t necessarily found the access point yet, but with the number of conversations we’re having it’s definitely on the radar,” she adds.

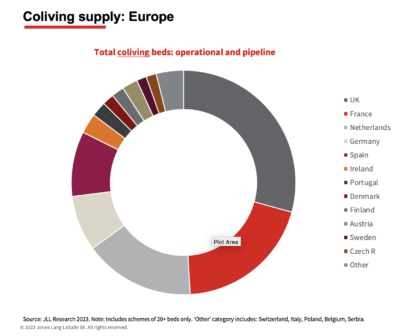

Most investment has been in the UK, France and the Netherlands, and more recently in Spain. “Smaller deal volumes have completed in Germany, Denmark and Sweden,” says JLL.

Co-living expands as real estate becomes more operational

The expansion of investor interest in the living sector is also part of real estate becoming more operational, explains Martin, a speaker on the investment panel at the MIPIM Co-Liv Summit.

In the past, investors were concerned about taking on operational risk … but that’s not the way of the world now – Julia Martin, JLL

Many investors looking at the sector have already had exposure to the living market and they are now expanding across the sub-sectors.

“In the past, investors were concerned about taking on operational risk. It’s easy to have a retail unit with a 20-year lease, and you gather the income once every quarter. But that’s not the way of the world now,” says Martin.

“Investors have become really comfortable with that operational risk, and residential in its wider sense falls into that operational sector,” explains Martin. “You’ve already seen this with co-working, where a multi-let office building is probably more resilient in terms of value than a single-let building.”

For Gravis Capital, which launched the GCP Co-Living Reit last year, co-living delivers “higher density housing compared to traditional living accommodation” and “it allocates space efficiently, allowing for greater occupancy whilst supplying high-quality accommodation,” says their UK report Co-living is Here to Stay.

It is important to have clear internal processes and to have the resident’s journey fully mapped out – Gui Perdrix, Co-Liv

Perdrix points out, however, that any scaling up of a co-living brand needs to be done in a sustainable way. “The more you scale, the harder it is to replicate the residents’ communal experience.

“This is why it is important to have clear internal processes and to have the resident’s journey fully mapped out, so that expansion doesn’t come at the expense of any loss in the quality of the experience.”

Guy Perdrix, director of Co-Liv

Investors are attracted by strong yields

Investors are attracted by yields that are higher than multi-family or build-to-rent, and closer to student accommodation levels, says Martin.

In Paris, for example, net initial yields for co-living were around 4 per cent at the end of last year, whereas for multi-family properties the equivalent figure was 2.3 per cent, says Martin. In Madrid, the figures were 4.1 per cent and 3.5 per cent, respectively. “Across European countries, the base points spread is between 40 and 175,” she explains.

Where is the demand for co-living coming from?

Feeding into the growth of co-living are five key factors:

- The dire shortage of affordable housing, and the growth of urban populations

- The rise in the number of single households

- The loneliness pandemic

- Increased demand for more ‘flexible’ ways of living, with flexible leases

- The rise of hybrid working and the digital nomad

Another factor is that GenZ, the first truly digital and global generation, is coming of age. The oldest GenZers are now 24 years old, and they are setting the trends in consumer behaviour, including for the older generations.

Names in the co-living headlines since last summer

The co-living sector is currently abuzz with talk about which operators will link up with which capital partners, points out Martin, with most investors needing to forward fund given the shortage of existing stock.

As the co-living ecosystem evolves, the market has seen much activity, including:

- ARK Coliving has opened its first property, a 300-room converted hotel, Wembley ARK in North London. The brand is a joint venture between Crosstree Real Estate Partners and Re:shape Generation.

- Greystar has launched the Be Casa co-living brand in Spain, following its acquisition of a portfolio of 2,500 units in three locations in Madrid from King Street. There have also been media reports of Greystar buying a further 2,400 Madrid rental units from Spanish residential developer Via Célere, owned by the Värde Partners.

- NREP has announced its entry into the German market as part of a joint venture with Swiss real estate developer Artisa Group to deliver 5,000 City Pop co-living units in Germany by 2050. The first two properties are in Berlin and Essen.

- Brussels-based co-living specialist Cohabs has joined forces with Ivanhoé Cambridge, Belfius Insurance and the Belgian Sovereign Fund (SFPIM – Real Estate) in order to accelerate the roll-out of its concept across 11 cities by the end of 2026.

- The Ascott Limited, owned by Singapore-based CapitaLand Investments and a key co-living player in Asia, is due to open its first lyf-branded co-living property in Europe, in Paris, in 2024.

"Making an impact"- White paper

Successful impact investing in real estate

Luca Bovone of Habyt: it’s about “conscious expansion”

Earlier this year, Habyt, the largest co-living operator in Europe and Asia announced its merger with the largest co-living operator in North America, Common.

Habyt operates over 30,000 units in over 50 cities, and with plans to grow to 100,000 units by 2026. Not only do they offer co-living, but also apartments, workforce housing and hotels/short stays. New openings over the next few years include in Berlin, Graz, Madrid and Barcelona.

Total capital raised by Habyt since the brand was founded in Berlin in 2017 is over US$150mn. Investors include Sequoia Capital, Mitsubishi Estate, Burda Principal Investments, P101, Vorwerk Ventures, Picus Capital, HV Capital and Norwest Venture Partners.

Luca Bovone, founder & CEO of Habyt, is a keynote speaker at MIPIM Co-Liv Summit

“This year we’re planning to expand into new countries in each of our three regions [Europe, North America, Asia],” says Luca Bovone, founder & CEO of Habyt.

“In terms of overarching strategy, we’re going to continue to focus on cities in our core regions. No remote co-living, for example, for now.”

Sustainable growth has been the key factor in our success thus far. Conscious expansion with the right properties in the right markets at the right time – Luca Bovone, Habyt

The Habyt model has a strong focus on digitalisation helping to provide tenants with a seamless experience and to operate buildings more efficiently.

And the secret to success: “Sustainable growth has been the key factor in our success thus far. Conscious expansion with the right properties in the right markets at the right time.”

A bedroom in a Habyt co-living apartment in Frankfurt.

The role of the E and a word of warning about the S

Many operators and investors point to co-living’s role in cutting carbon emissions, given the higher density of living.

The community-building aspect of co-living is also cited as a boost for the S for ‘social’ in ESG, but there are words of warning about developing large, high-density projects.

“There is little, if any, serious post-occupancy research designed to understand the impact of co-living on the wellbeing of people living in small units with shared amenities,” says Jonny Anstead, founding director of UK profit-for-purpose developer TOWN and chair of the UK civic and social organisation Quality of Life Foundation.

The rise of housing as lifestyle

So where is the market heading? “We’re seeing the rise of housing as a brand, as lifestyle, with investors no longer seeing the living market as totally segmented,” says Martin of JLL.

Investors [are]no longer seeing the living market as totally segmented – Julia Martin, JLL

“What’s coming from operators is, ‘you had a good time with us as a student, and now come into co-living with us and we’ll look after you there as well,” says Martin, pointing to the example of Unite, the biggest REIT in UK student accommodation, and also an operator, buying a build-to-rent/co-living model in Stratford, East London.

Co-living not just for young professionals – La Casa in France

Most operators are targeting the young professional market as a first step, but many see demand as being much wider, and more nuanced.

Co-living operator and investor La Casa, for example, which so far has raised €30mn in capital, is launching two Grandes Casas for “autonomous” seniors in the Paris region.

La Casa Verte in the Parisian suburb of Antony

At present, La Casa has more than 40 co-living properties in the greater Paris region, ten of which were opened last year and a further ten are currently being renovated. The focus is on renovating large houses in suburban locations close to public transport.

The community is the main reason people join La Casa – Victor Augais, La Casa

All the properties are themed. For example, La Casa offers houses for chefs (with a large cooking area), as well as for cinema lovers, sports & wellness enthusiasts, and ‘green’ advocates.

“But the community is the main reason people join La Casa,” says Victor Augais, founder & CEO of La Casa. Everything is thought through to support the development of connections, even the adoption of a ‘co-opting’ model, with new residents selected by existing ones.

“92% of housemates say that La Casa is an environment that facilitates the development of friendships,” says Augais.

See you at the MIPIM Co-Liv Summit!

When MIPIM World connected with Gui Perdrix of Co-Liv, the conversation started with Perdrix holding up his phone to share the view of the rooftops of sunny Lisbon from the co-living space he is currently renting.

A month in warmer climes as a digital nomad is appealing, especially given co-living’s flexible lease terms: one month could easily roll into three … and even a year, or two.

Register to join the MIPIM Co-Liv Summit at the Palais des Festivals in Cannes on Monday 13 March 13.00 – 22.00. Free for MIPIM delegates and otherwise €300

Main picture: La Casa Verte in the Parisian suburb of Antony.