As recession bites, the need to build more affordable homes * is soaring. Even before the UK economy plunged below zero growth, one in seven people in England were living in an unaffordable, insecure or unsuitable home.

At the same time, nearly 80 per cent of private and institutional investors in Europe expect to increase their investments in affordable housing over the next 12 months, reveals the European Living Investor Survey 2020, published by JLL in partnership with Aberdeen Standard Investments.

“Big capital flows into housing from private investors will enable greater swathes of affordable housing,” Adam Challis, executive director, EMEA capital markets research & strategy at JLL, told the MIPIM Connect webinar on global innovations in affordable housing.

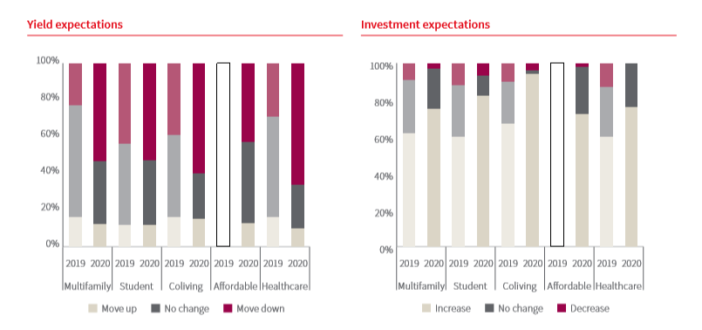

Source: JLL’s European Living Investor Survey 2020

Building resilience to attract investment

The response to the 2008 global financial crisis was to minimise costs. Now, as we live through the economic fallout from Covid-19, it is about building resilient cashflows, says Challis.

Building resilience into housing assets is about better property management, being more in tune with tenants’ needs, and creating more desirable and more environmentally and socially sustainable properties, he adds.

“I am really encouraged that today you can talk about ESG as a mindset and an enabler for more investment activity, as opposed to where we were ten years ago” – Adam Challis, JLL

“I am really encouraged that today you can talk about ESG as a mindset and an enabler for more investment activity as opposed to where we were ten years ago”, says Challis.

Hyde housing association – looking for investor partners

As investors equipped with an ESG mindset look for long-term, secure returns, the housing associations in the UK, non-profit, registered providers of social housing, are looking to build more housing.

Housing associations are a powerful force in the UK housing sector, owning or managing nearly 20 per cent of all homes across the country.

The Hyde Group focusses primarily on south-east England. It has 50,000 properties, most of which it owns, and 105,000 residents. Its Rochester Riverside scheme was this year’s Winner of Winners at the UK Housing Design Awards.

“Our constraint is capital; we need to work with the right partners to help us to build more because the shortage of affordable housing in the UK is severe” – Catherine Raynsford, the Hyde Group

Catherine Raynsford joined Hyde this February in a new role as director of stakeholder & investment management. Previously she was a director at JLL, where she specialised in public-private partnerships.

“We have the development capability and the operational platforms to deliver and manage more homes,” she says. “Our constraint is capital; we need to work with the right partners to help us to build more because the shortage of affordable housing in the UK is severe.

“Covid-19 has created greater focus on the ‘S’ of ESG, and housing associations, with social purpose at their core, have a track record in delivering measurable social impact” – Raynsford

“We see a very obvious synergy with those investors who are seeking long-term, secure, sustainable income streams and who, like us, are motivated to deliver positive impact in real estate, in the community and in place.”

“Covid-19 has created greater focus on the ‘S’ of ESG, and housing associations, with social purpose at their core, have a track record in delivering measurable social impact.”

“We are are looking to countries across Europe where there is a longer track record in institutional investment in affordable housing” – Raynsford

It is about finding the “right cultural alignment”, says Raynsford. This is not only with regards to long-term objectives and return requirements, but also ESG and prior experience investing in affordable housing.

“We are looking beyond the UK, to countries across Europe where there is a longer track record in institutional investment in affordable housing,” says Raynsford.

“We see a clear role for an organisation … that facilitates understanding and helps create the right alignment between the capital partner and the registered provider of affordable housing” – Raynsford

The executive leadership team at the Hyde Group has strong expertise in investment and banking. That is not always the case in the housing association sector.

“We see a clear role for an organisation, or a body, which could be governmental, that facilitates understanding and helps create the right alignment between the capital partner and the registered provider of affordable housing,” says Raynsford.

At JLL, Raynsford was part of a multi-disciplinary team advising on the agreement between Japanese modular housing pioneer Sekisui House, and Urban Splash and Homes England, the government’s housing accelerator. “It was very important to have Homes England there at the table,” she says about the deal.

PfP Capital’s MMR Fund attracts £140mn

One of the first fund managers in the UK to launch a fund focussed on the affordable housing market was PfP Capital, the fund management business established by Places for People. PfP Capital launched its Mid-Market Rent (MMR) Fund in 2018.

This July the fund manager announced that it had more than £140m committed in the fund, making it on track to reach an initial £160mn target. Investors to date include the Nationwide Pension Fund, Strathclyde Pension Funds, Castle Rock Edinvar and the Scottish government.

The fund was established to deliver a minimum of 1,000 affordable mid-market rental homes within commuting distance of Scotland’s main cities as part of the Scottish government’s commitment to deliver 50,000 affordable homes by 2021.

William Kyle, Fund Director, PfP Capital, said: “This fund has a unique proposition for investors. It has social impact at its core, delivering much needed additional affordable homes in Scotland to those on low and modest incomes who are not able to take advantage of social housing nor can afford traditional private rentals. The fund will also deliver consistent, CPI-linked returns to investors.

Legal & General Affordable Homes secures first four schemes

One of the UK’s biggest investors in real estate, the Legal & General Group set up Legal & General Affordable Homes in 2018, which now has a pipeline of over 3,500 homes and is on track to create 3,000 new homes annually by 2023.

Legal & General’s affordable housing business, which works in partnership with 14 established housing associations and providers, announced last year that it had secured its first four schemes, comprising 278 new homes in Croydon, Cornwell, Dunstable and Shrivenham.

This followed the announcement earlier in the year by Legal & General that it had provided £100m of long-term debt financing to its affordable housing business with an additional £175m of development finance provided by a consortium of external investors.

As with all new homes invested in or built by Legal & General, all of the Legal & General affordable homes will be operational net zero carbon enabled by 2030.

Some of the first homes built by Legal & General in Dunstable, Bedfordshire

Benefits from the sustainable delivery of housing

The JLL European Living Investor Survey 2020 also reveals a big shift in attitudes towards sustainability over the last year. In this year’s survey:

- 94 per cent (up from 80 per cent) of respondents believe investments in the living sector will be more focussed on sustainable assets.

- 77 per cent (up from 69 per cent) have sustainability mandated within their investment structures.

The sustainable delivery of affordable housing brings a whole range of long-term benefits for tenants, landlords and governments, says Challis, who is also a board trustee for World Habitat, a not-for-profit organisation.

Technology has a key role to play as an enabler of sustainability. This is both in relation to digital technology and to hardware, such as modular construction, he adds.

Modular construction methods (MCM) are particularly well suited to affordable housing. Not only does MCM reduce costs, improve quality, and create a more energy efficient building, but it also works well with affordable housing as homes can be rolled out quickly, says Challis.

Legal & General, for example, has a separate business, Legal & General Modular Homes, with a factory near Leeds.

A key challenge: measuring and assessing performance of social impact

A key challenge going forward will be how ESG is measured in a sector where, quite naturally, there is no control over how residents use their homes. Existing methods of sustainable performance measurement and assessment are predominantly focussed on the commercial sector.

“There is very early stage work going on, including from the British Property Federation and on the fund level from AREF, to better define ESG for residential real estate – Alex Notay, PfP Capital

“There is very early stage work going on, including from the British Property Federation and on the fund level from AREF [Association of Real Estate Funds], to better define ESG for residential real estate and to grapple with the granularity of operational data around people’s homes,” says Alex Notay, placemaking and investment director, PfP Capital, who is chairing the BPF sub-committee on residential ESG.

£723m – the social value of the Hyde Group portfolio

The Hyde Group already operates a social value model which put the group’s total annual social value at £723m in 2019/20. This includes savings related to health, local authority spending, the justice system, as well as higher employment rates and lower absenteeism, as well as the economic benefits of building and maintaining homes.

The group is in the middle of broadening out the analysis and taking it right across the ESG spectrum. Now, the next step is to meet with other housing associations (a sector which works closely together) to discuss a common set of metrics and to meet with a group of investors, convened by Big Society Capital, the social impact financial institution.

“It is about knitting together the impact criteria from the investor’s perspective and the impact metrics from the housing delivery perspective” – Raynsford

“It is about knitting together the impact criteria from the investor’s perspective and the impact metrics from the housing delivery perspective,” says Raynsford.

“Being able to articulate the impact we deliver in pounds and pence is critical when talking with investors, the treasury and with the outside world.”

As Challis says: “The one thing people ought to be able to rely on is a good, safe, high-quality home. If we can get to a stage where that is accepted in practice as an outcome of house building, then this would be a real leap forward in what we see as the role of the real estate industry.”

*The UK government defines affordable housing as “social rented, affordable rented and intermediate housing [such as shared equity], provided to eligible households whose needs are not met by the market”.

Top Image: The redevelopment of the Packington Estate in the London borough of Islington by the Hyde Group