Paris tops this year’s city ranking in Emerging Trends in Real Estate: Europe, the annual survey by PwC and the Urban Land Institute. Respondents noted the city’s ability to attract capital of all kinds from around the world.

This comes at a time when Paris has (narrowly) overtaken London as the most active commercial property market in Europe.

Total investment volumes in the French capital are at €21bn in the year to date [20 November], of which just over half is accounted for by cross-border investors, calculates Real Capital Analytics.

As investors shy from the UK’s Brexit uncertainties, investment is down 32% in London while up 23% in Paris, says Real Capital Analytics, albeit that the UK remains the first port of call for new global entrants.

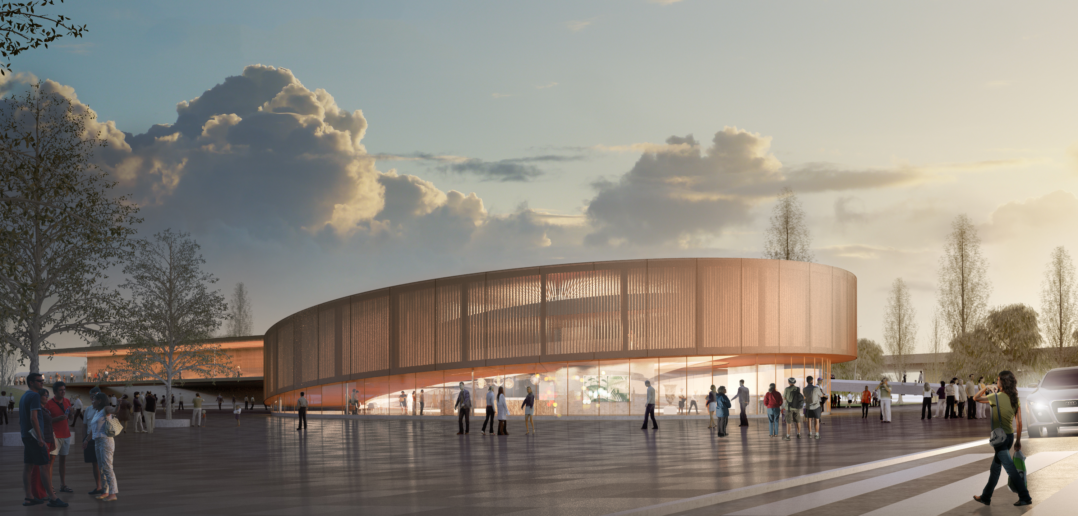

The new Pont de Bondy station on Metro line 15

Why are investors attracted to Paris?

“Europe’s low rate environment continues to be real estate’s trump card … pulling more and more capital into the market,” says Real Capital Analytics in its Q3 2019 Europe Capital Trends.

Offices have accounted for 75% of investment volumes in Paris so far this year, says Real Capital Analytics, compared with 65% in London.

In addition, Paris is attractive to investors because it offers:

- Opportunities to invest at scale and in a liquid

- Low CBD office vacancy rates, with office yields still under pressure.

- A service-focused economy relatively protected from global trade jitters.

- A city ambitious to renew itself for the 21st century, in particular through improved mobility.

Asian investors expand in Paris

South Korean investors in particular have been active this year in Paris. They account for many of the big-ticket transactions over €500m signed so far in 2019:

- Investment manager Swiss Life Asset Managers bought a portfolio of 28 office buildings valued at €1.7bn. 90% of the portfolio is in the Paris CBD in the 1st, 2nd, 8th, 9th and 10th Seller: Terreïs.

- Purchase by a joint venture between Primonial REIM and Samsung Securities/Hanwha Inv & Secs of the Lumière office building in the 12th arrondissement for €1.22bn. Seller: Tishman Speyer.

- In its first acquisition in Europe, South Korean securities firm Mirae Asset Daewoo in partnership with French asset manager Amundi Real Estate acquired Tour Majunga, the third tallest tower in the Paris region, in La Défense business district to the west of Paris for €850mn. Seller: Unibail-Rodamco-Westfield.

- Samsung Securities, with La Française Real Estate Partners as a minority co-investor and as building manager, acquired the Crystal Park office building in Neuilly-sur- Seine in western Paris for €691m in its fourth acquisition in Paris. Seller: Caisse des Dépôts.

- NH Investment & Securities acquired a 49% stake, valued at €365m – and based on a total asset value of €745m – in Eqho Tower in La Défense. The South Korean investor has an option to purchase the remaining 51% by the end of 2020. Seller: Caisse des Dépôts.

Grand Paris Express – connecting the Paris region

As the PwC/ULI report notes, ‘mobility’ is becoming an increasingly important part of real estate as a ‘service’.

A key attraction of the Paris market is Grand Paris Express, Europe’s largest transport project run by public body the Société du Grand Paris (SGP).

“The GDP of the Ile de France region will increase by 2.61% by 2037” –the EU Science Hub on the economic benefits of the Grand Paris Express

Grand Paris Express is set to boost the GDP of the Île-de-France region by 2.61% by 2037, according to a report by the European Commission, as productivity increases with a better matching between the supply and demand of skills, and with increased accessibility.

The new Clichy-Montfermeil station on Metro line 16, designed by Miralles Tagliabue EMBT & Bordas+Peiro

The project includes the laying of 200km (124 miles) of new train lines – almost double the size of London’s new Crossrail line – with 68 new interconnected train stations, and 90% of the lines built underground.

The Grand Paris Express project connects suburb with suburb, suburb with city, and with Paris’ three airports

Work began in 2016, and is due to finish in 2030, connecting suburb with suburb, suburb with city, and with Paris’ three airports, including a new Charles de Gaulle Express train, direct from France’s main international airport to the heart of Paris.

Grand Paris Express is also opening up fresh opportunities for investors as new hubs of economic and social activity are created in one of the world’s top global cities.

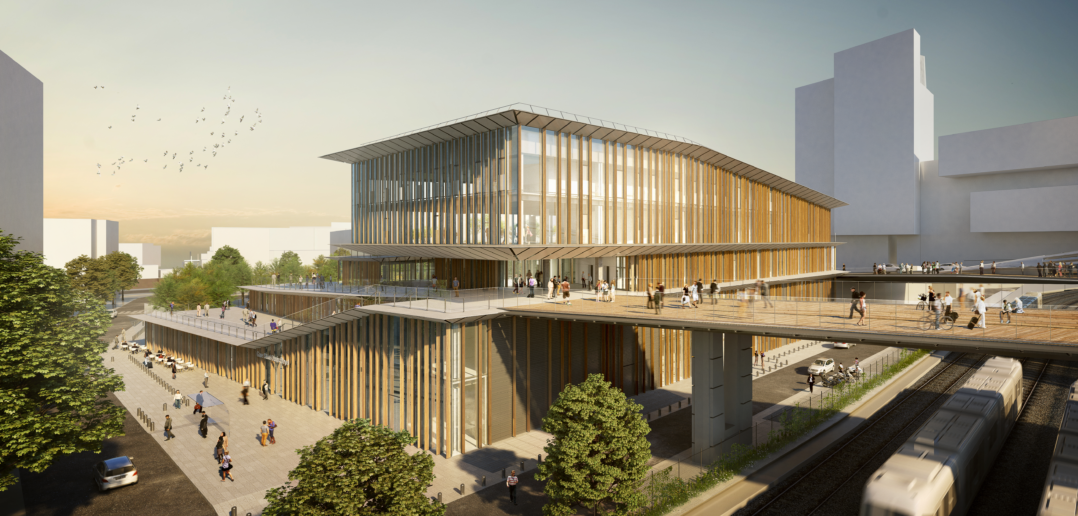

The new station at Sant-Denis Pleyel designed by Kengo Kuma at the intersection of Lines 14, 15 and 16/17. Saint-Denis Pleyel will become a key transport hub in the French capital, at the intersection of Lines 14, 15 and 16/17

Seven economic clusters have been identified. Some are already established, such as La Défense, and others are new, such as Saint-Denis Pleyel, which will become a key transport hub, at the intersection of Lines 14, 15 and 16/17.

A range of opportunities will also highlighted by United Grand Paris Pavilion at MIPIM 2020.

Paris Olympics 2024 – inventing the European city of 2050

Nicolas Ferrand, CEO of SOLIDEO, the public company delivering the Olympic Games projects, spoke at MIPIM 2019 about inventing the European city of 2050 through the building of the Paris 2024 Olympic & Paralympic Village.

The ground-breaking ceremony for the Village, designed by French architect Dominique Perrault, took place this November. It is being built on either side of the Seine, north of Paris, and across three communes: Saint-Denis, Saint-Ouen and L’Île-Saint-Denis.

Allee de Seine ©Solideo Dominique Perrault – Architecte Adagp

The Media Village, meanwhile, is adjacent to Le Bourget airport, also to the north of Paris, and near the Georges Valbon park, the third biggest green space in the Paris region.

The Paris Olympics aims to host the most sustainable games ever, aligned with the UN Sustainable Development Goals. The Games’ carbon footprint is set to be 55% less than for London 2012, widely seen as a reference for a sustainable Games.

To help with air pollution, the city of Paris has created 40 hectares of new green space since Mayor Anne Hidalgo took office in 2014, including new pedestrianised areas along the Seine river banks.

And in a bid to further reduce vehicle traffic, which the town hall estimates is currently falling by 5% a year, Hidalgo is aiming for 1,000km of bike lanes across Paris by next year, up from 700km in 2015. This is a good time to get out the cycling gear when you next visit Paris.