The Nordic countries are an overall good investment according to experts who shared their insight during the session “Investing in the Nordic countries: is it still a good choice?”. The panel included Tor Borg, Chief Economist of SBAB Bank, Agneta Jacobsson, International Director and Managing Director for DTZ Sweden AB, Laurent Jacquemin, European Head of Transactions for AXA Real Estate, Anneli Jansson, Nordic Director for Grosvenor Fund Management Europe and Zsolt Kohalmi, Head of European Acquisitions for Starwood Capital Europe Advisors.

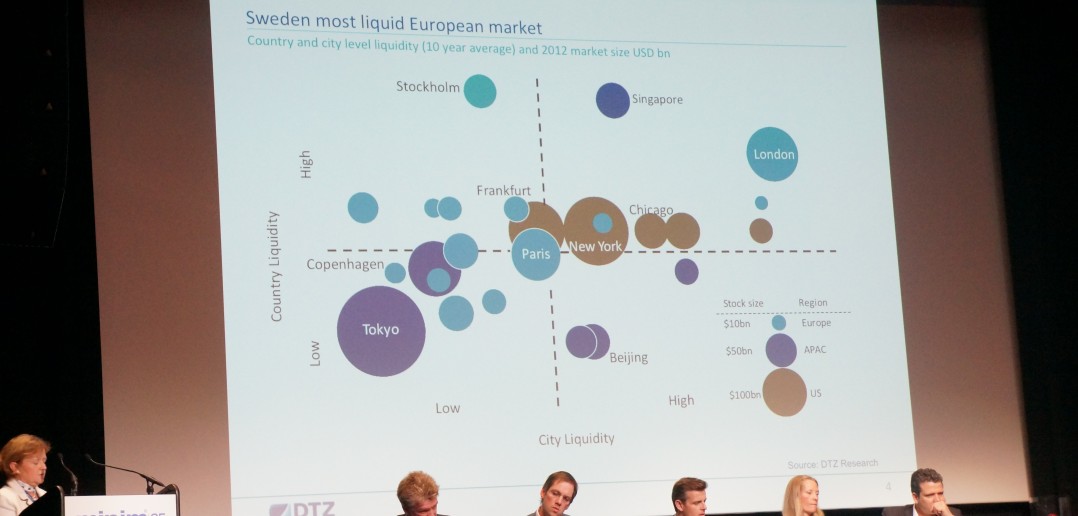

Details were given of the demographics and industry trends that make the Nordic real estate environment, but it was generally understood that the Nordic countries are overlooked because they are a relatively small market and every new country requires it’s own local expert. Jacobsson & Jansson noted it was difficult to speak of the Nordics as one because each market is so diverse--Denmark housing prices were down while Sweden & Norway’s were up. Different levels of interest rates and housing supply come into play. Risks to investing in the Nordic countries are high household debt compared to the rest of Europe, but long term debt caps are being implemented. Positives, on the other hand according to Borg were liquidity of investment and market transparency. Inflation is stable at 2% and similar demographic booms just like everywhere else, but multifamily would not thrive due to government regulation on rent and ability to rent out space or own rental property. He noted the Nordic countries are known for their fishing, forestry, technology industries (Spotify, Skype & Angry Birds app) and Pharma.

Jacobsson gave a very informative presentation on each of the Nordic countries and a few takeaways were: Copenhagen Indus/retail & Helsinki are hot – very good returns while Copenhagen Helsinki & Stockholm office market are warm – fair return.

Sweden – low supply, high prices

Finland – strong consumers, prices not yet high

Retail trends – e-commerce is 6% of total retail sales. Having a significant effect on retail space and sales.

Written by Lauren M Burns, University of San Diego. Lauren is a 2015 MSRE Candidate at the University of San Diego and California licensed Realtor for Blue Chip Realty Group. She appreciates her generalist education in all aspects of commercial real estate for preparing her to fully transition into the field and serve the business community as a knowledgeable leader and innovator. @Laurenderella

Written by Lauren M Burns, University of San Diego. Lauren is a 2015 MSRE Candidate at the University of San Diego and California licensed Realtor for Blue Chip Realty Group. She appreciates her generalist education in all aspects of commercial real estate for preparing her to fully transition into the field and serve the business community as a knowledgeable leader and innovator. @Laurenderella