The Life Science and Biotech real estate sector has seen a significant surge in development and leasing in recent years in areas like Boston, the San Francisco Peninsula, and San Diego. Driven by record breaking levels of venture capital funding and advances in technology, Life Science has proven to having staying power as a desirable product type to investors and developers. But, as these regional pockets have been established as leaders for the sector around the nation, it is important to assess why these markets became the primary markets and identify which secondary or tertiary markets could be the next burgeoning regions for Life Science developers and companies to find their homes.

What Makes For a Successful Region?

While there are countless factors that make an area desirable for different sectors of real estate, different sectors have different indicators. In Life Sciences, some of the most important leading indicators are the vicinity to education and the access to funding. While not all markets are created equal, these two factors remain consistent within the primary Life Science markets like Boston, the San Francisco Peninsula, and San Diego.

The education sector

Elite universities are a breeding ground for top talent in different business verticals who ultimately populate their alma mater’s surrounding regions. Ivy league schools produce top financial and economic minds that lead New York’s largest institutions while Stanford and Cal Berkeley have grown some of the most innovate minds that created Silicon Valley and the tech industry we know today. In Life Sciences, this impact is no different. As the demand for top Life Science talent has grown, these Universities have met the challenge. The vicinity to major research universities has a direct correlation to the density of Life Science properties in that region. For example:

The below map shows Harvard, MIT, and Boston University (amongst others) in Boston in correlation to all current Life Science buildings in the Boston area (represented by the teal markers)

Source: Avant by Avison Young

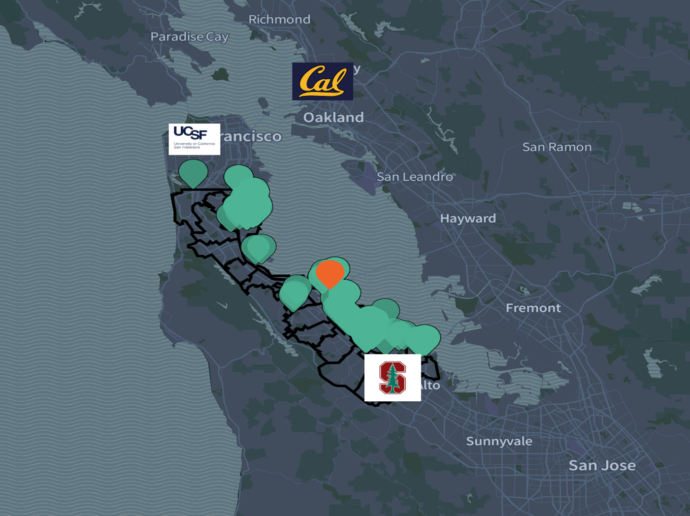

Stanford, Cal Berkeley, and University of California San Francisco in the San Francisco Bay Area. Source: Avant by Avison Young

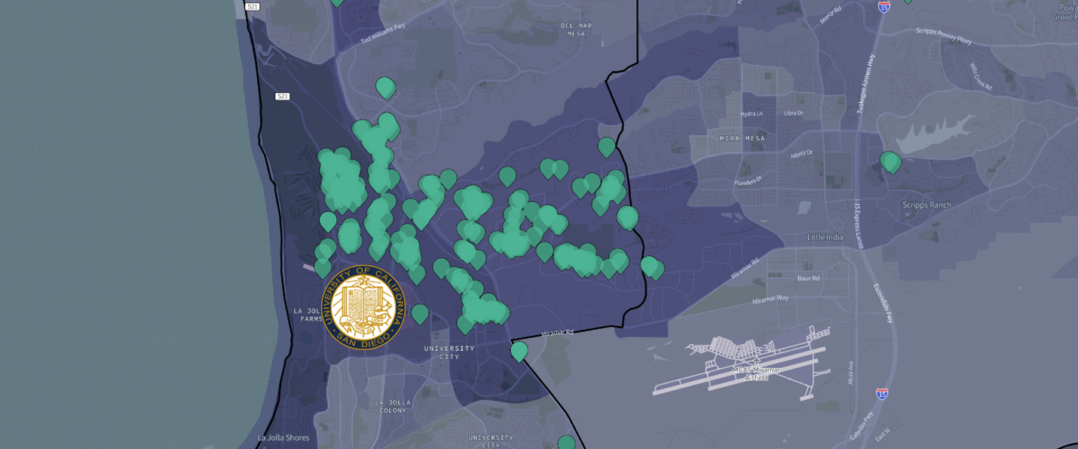

University of California San Diego in San Diego.

Source: Avant by Avison Young

The impact that these universities have had on the immergence of Life Science development is substantial. They have provided the region with talent and with that talent, companies have been given the opportunity for the next indicator of Life Science growth, funding.

Funding

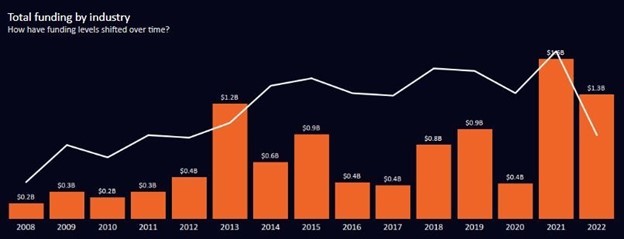

While there are multiple sources of funding that indicate growth in a region, I am looking specifically at VC funding in each of these areas. According to Avant by Avison Young, since 2008, of all cities who have received VC funding for Life Science specific companies, 8 of the top 9 are in the 3 regions mentioned above:

This staggering amount of funding has paved the way for quick and scalable growth for companies. As these larger companies grow, there is an effect almost like the Gold Rush of the 1840s; other companies will begin to pop up in these regions seeking that same success that their forbearers experienced, hoping that being in the vicinity of the larger companies will position them to grow in equal fashion.

Where is Next?

As a sector grows and primary markets become harder to enter due to costs, lack of supply, or companies looking to catch lightning in a bottle and be trailblazers, secondary and tertiary markets will emerge. Predicting where these markets will be will prove to be both lucrative for an investor and life changing for strength of those communities. Using the indicators established above, I wanted to highlight both a secondary and tertiary market that I believe could be the next area for massive growth in the Life Science sector.

Secondaire – The Raleigh-Durham region

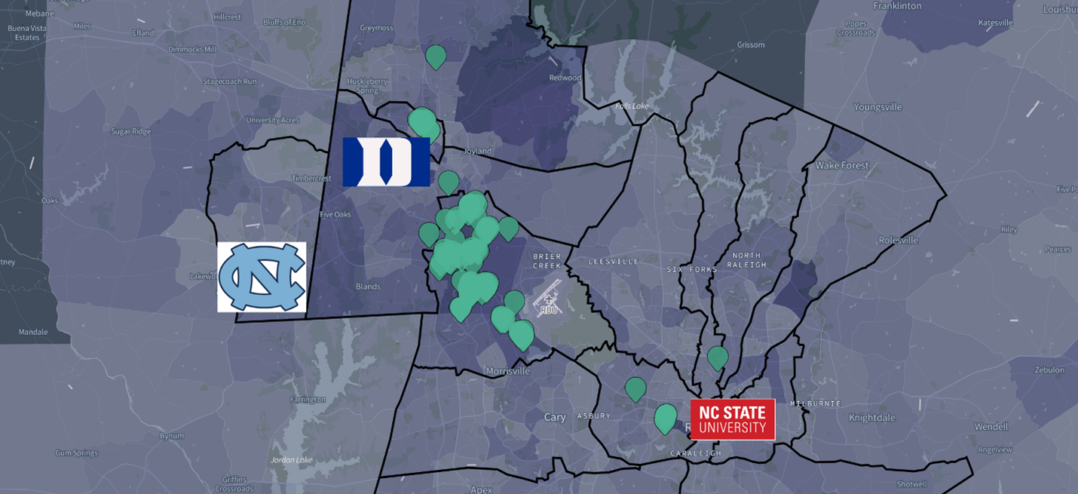

While I am not going out on a massive limb here, the Raleigh-Durham region (also referred to as the Research Triangle) has been stablishing itself as an affordable alternative to some of the more metropolitan primary markets dominating the sector. Tucked between North Carolina State University, University of North Carolina Chapel Hill, and Duke University, this area has grown rapidly in recent years and, according to Avant by Avison Young, is expected to grow as much as 7.6% in some micromarkets by 2028. This population growth and influx of talent from these universities will give the Raleigh-Durham area the opportunity to expand its Life Science presence even more than it already has.

Source: Avant by Avison Young

From a funding perspective, Raleigh-Durham has also seen significant growth in recent years. Even as VC money is retracting due to the on-going economic uncertainty through Q3 2022, Raleigh-Durham is still receiving record numbers of funding dollars. This will help to continue the growth of companies to utilize more talent and grow their real estate footprint.

Source: Avant by Avison Young

Tertiary – The Sacramento region

While there is less of a statistical basis for this given that the Life Science sector has taken a foothold in Sacramento yet. There are indicators and potential tailwinds coming for Sacramento that will provide a blueprint for growth in the coming years. First and foremost, UC Davis has become and will continue to be a preeminent research university in the country and is investing heavily in their growth as a university. According to the University, a multi-phase, mixed use development with an emphasis on medical and life sciences uses will begin construction in 2022 or 2023. This project will create nearly 15,000, most of which will require top medical and life science talent. Additionally, with the growing number of transplants from the Bay Area into Sacramento, there will likely continue to be eyes on the region for growth in Bay Area-inspired industries like tech and life sciences.

The Life Science sector has established itself as an industry that is not only fruitful for real estate investment, but also the betterment of the world at-large, so it is no surprise that there is going to continue to be growth in both primary and emerging markets. While the growth of these emerging markets is not a foregone conclusion, it will be important to look to these factors as rationale to why these areas are primed for growth.

More about MIPIM 2023, The leading Property Market!