Inflation vs. Cost of Debt

The inflation rate in the US recently peaked at 7.5% in January 2022, the highest level since February 1982. Other currencies like the Euro are also under pressure with a current inflation rate of around 5.1% in January 2022, rising from 5.0% in December 2021 and about as high as last seen in the Euro area in 1985[1][2].

Whitepaper : LBS political leaders summit

Intuitively, looking at inflation vs. cost of debt seems pretty simple: Inflation will reduce the current cost of debt for fixed-rate mortgages locked in the past, since the overall real value of the loan will get lower. If property income stays the same or increases, the nominal and real property value will increase too. So, is it safe to say that investors should lock in as much fixed rate debt as they can right now?

Inflation and cost of debt for housing – traditional approaches

A lot of scientific articles dealing with the impact of inflation on real estate prices date back to the 1970s and 1980s, a period characterized by even stronger inflation than today in the US. Critical to these discussions are “expected inflation” and the associated consequences and actions of individual market participants.

Based on long-term, fixed-interest, nominal-payment mortgages common in real estate finance, traditional thinking suggests a decline in demand for housing during high inflation periods, based on higher mortgage rates.

In a 1979 article in the Journal of Political Economy, it is described that for a 30-year mortgage with 3% real interest, payments are 25% higher when only 2% inflation is expected compared to when no inflation is expected. Thus, in the real estate context, inflation does not affect the current financial situation of a household, but the current real cost of debt for future mortgages, which is based on future expectations. (Kearl, 1979)

In a paper by Follain in 1982, it was found that a 1 percent increase in the anticipated inflation rate of the general price level causes aggregate housing demand to drop by about 4 to 5 percent. Similarly, it was discovered that the probability of homeownership declines with an increase in the inflation rate. For the sample of all households, a 1 percent increase in the rate of anticipated inflation is estimated to reduce the homeownership rate by more than 3 percent. (Follain, 1982)

This is a result of the tilt effect built into mortgage rates. Higher inflation rates make new mortgages much more expensive early in the life of a mortgage and quite cheap later on, should the mortgage not be repaid early.

Are those traditional relationships applicable in today’s times?

Intuitively, one would assume that things look a little different. Inflation at any level implied money is worth more today than tomorrow. According to this logic, it would make sense to hold as little cash as possible in the present, but to invest it in real assets, whose value ideally grows along with, or even exceeds the growth of inflation. However, this requires a certain (basic) financial understanding which cannot be expected from the average participant in the housing market.

In the housing sector, where we usually deal with many owner-occupiers who are not real estate or financial professionals, an interesting counterintuitive phenomenon was observed in a study published in The Review of Financial Studies in 2008. Specifically, it refers to « money illusion. » This phenomenon describes those homebuyers who, when comparing rents with mortgage payments, simply compare the nominal values and do not take inflation into account. Thus, the fact that inflation reduces future real mortgage costs is not considered and therefore leads to an incentive to rather rent than buy when inflation is high since nominal fixed mortgage rates will be higher when inflation is high. (Brunnermeier & Julliard, 2006) Again, this is a result of the tilt effect.

Whitepaper : LBS political leaders summit

Another issue is how lenders behave in this situation. For them, of course, it becomes more expensive to issue loans in the present. However, since they cannot predict how inflation will affect a 30-year loan, uncertainty or high expectations regarding future inflation will play a big role.

In a paper by Caglayan, Xu, it could be shown that uncertainty harms the dispersion of the net loans-to-assets ratio and corporate and commercial loans-to-assets ratio. This shows that bank managers have more of a preference for idiosyncratic lending when inflation volatility is low, as they can better predict the returns from each project; as well as that they behave similarly during periods of high inflation volatility. This observation implies that when inflation volatility is high, scarce bank resources are not allocated efficiently. (Caglayan & Xu, 2016)

Another thing to consider different today than back in the 70s and 80s is housing supply. Studies have shown that supply has gotten less elastic since the crisis in 2008/2009. This means that the sellers, so basically developers and current home owners who are willing to sell, will be less sensitive to changes in price and adapt more slowly. This can be explained by a number of reasons, for example a stubbornness of sellers to rather wait longer to sell their homes instead of accepting a lower price, or even take it off market, depending on their discretion on time. Another reason could be that land to develop has become more scarce with time and stricter zoning regulations are reducing supply naturally.

What happens to real property value and does it work as a hedge against inflation?

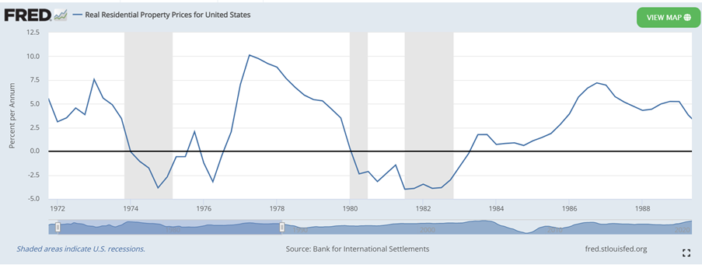

So even though the previously cited theory suggests that high inflation reduces demand, overall demand for real estate is of course also driven by other factors than inflation, like interest rates, demographics, economic cycles, etc. If you look at aggregate real housing prices in the US, during the last high inflation period, from the mid-70s until the beginning of the 80s, there is no clear trend visible, but rather 3-year cycles of ups and downs, as seen in figure 1

Figure 1: Real Residential Property Prices in the US 1972 – 1992, Source: FRED

CBRE published a study where valuation and income from real estate were matched with the CPI of the US over a period of 38 years. Interestingly, only retail has proven to be a safe hedge against inflation, both in terms of income and valuation, with an elasticity of over 1 in each case. Although it is important to mention that a period from 1978 – 2016 was observed. Nowadays e-commerce trends and especially Covid impacts will play a big role in re-assessing this asset class, with probably a bigger trend towards more service and less goods. Apartment and Industrial real estate values have also shown to be reliable against inflation, with elasticities of .98 and .91, respectively, but not so much for their rental income (.56 and .71). Office performed the worst on both measures, with an elasticity on revenue of .18 and on valuation of .74. The poor performance of office real estate, especially on revenue, can also be explained in part by the fact that office buildings simply become technically and physically obsolete over time, and thus also generate less revenue and lose some value. The fact that valuation performs better than revenue in all observed real estate sectors can be explained primarily by the trend of declining cap rates in the past 30 years, which also overall align with falling interest rates in the observed period.

In conclusion, during a high inflation period, the cost of debt will of course decline for fixed-rate mortgages that have been locked in the past. But the theory suggests that, as soon as inflation expectations are rising, lenders will adapt their rates accordingly, or even excessively because of uncertainty, and therefore equalize any benefit regarding the cost of debt for future mortgages. Furthermore, theory suggests that demand, at least for housing, will actually decrease and therefore lead to a decrease in real housing value.

References

Brunnermeier, M. K., & Julliard, C. (2006). MONEY ILLUSION AND HOUSING FRENZIES. NBER WORKING PAPER SERIES.

Caglayan, M., & Xu, B. (2016). Inflation and Volatility Effects on the Allocation of Bank Loans. Journal of Financial Stability.

Follain, J. R. (1982). Does Inflation Affect Real Behavior: The Case of Housing. Southern Economic Journal.

Kearl, J. R. (1979). Inflation, Mortgage, and Housing. Journal of Political Economy.

[1] https://www.statista.com/statistics/273418/unadjusted-monthly-inflation-rate-in-the-us/

[2] https://data.worldbank.org/indicator/FP.CPI.TOTL.ZG?locations=XC

You may also be interested in another article from a student of University of San Diego: Diplomacy in Development – How to deal with NIMBY-ism

See the full at-a-glance conference programme for MIPIM 2022.