As many of us ponder what shape and form our summer holidays will take, the European hotel sector has a one-off opportunity to make itself not only more sustainable, but also more resilient as an investment.

This July, EU member states will discuss a €750bn European post-coronavirus recovery plan, put forward by the European Commission.

If the plan had a colour, it is likely that it would be green – a colour much needed in the hotel sector, which accounts for 8% of global greenhouse gas emissions.

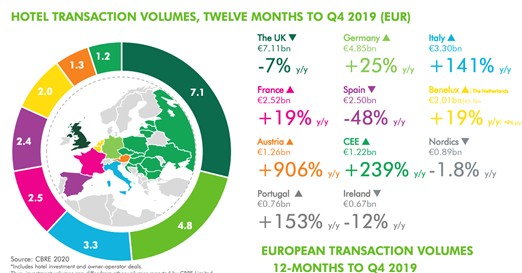

Who could have seen the pandemic storm clouds gathering in 2019 – a record year for international tourism, and a year when hotel investment volumes rose 13.9 per cent, reports CBRE, with the top five markets in Europe being the UK, Germany, Italy, France and Spain.

Looking to 2020, Miguel Casas, senior director & head of hotel investment properties, Continental Europe at CBRE says “Key European gateway cities such as London, Paris, Amsterdam and Rome are likely to see increases in transaction volumes later in the year as the market accepts some discounts in hotel pricing versus pre-Covid levels, which will make these assets attractive again.

This investment uptick will be a great sign for investors after the pause in activity we are currently experiencing, whereby hotel operations have been largely shut for some months due to the impact of coronavirus – Casas

Right now, the skies are almost empty; the Flightradar24 app is telling me that not one single plane is flying over North London. However, air ‘corridors’ are being drawn up across Europe and hotels are starting to open their doors once again for guests.

Travel will be back. We are only human. What form it will take is an open answer. What is certain is that the opportunity for investors to give their assets a sustainable overhaul – and hence to preserve the value of their investments – has never been greater.

The ten-year opportunity gap for hotels

The MIPIM Connect panel on Sustainability & ROI for Hotel Development, co-organised with the PKF hotelexperts group, focused on what Adam Maclennan, managing director of PKF, and who chaired the session, called the “sea change” of sustainability in the world in which we live.

Xenia zu Hohenlohe, founder & managing partner of the Considerate Group, a global advisor to the hospitality sector on sustainability, who also took part in the session, pointed out: “The hotel sector has a ten-year opportunity gap.”

“The hotel sector has a ten-year opportunity gap,” said Xenia zu Hohenlohe, founder & managing partner of the Considerate Group, a global advisor to the hospitality sector on sustainability, in a MIPIM Connect webinar called « Sustainability & ROI for Hotel Development. »

Those ten years coincide with the 2030 Agenda for Sustainable Development Goals, which dovetails the Paris Agreement adopted in 2015.

The Paris Agreement – the first universal, legally binding global climate change agreement – aims to limit global warming to 1.5°C; anything above this level would be catastrophic, say scientists.

A myth we need to bust straight away is that sustainability costs more – Xenia zu Hohenlohe, Considerate Group

“This is a pretty tight window when you’re thinking of a 10 to 15-year turnaround for your investment asset,” said zu Hohenlohe, who was taking part in the MIPIM Connect panel on Sustainability & ROI for Hotel Development.

“A myth we need to bust straight away is that sustainability costs more. It doesn’t. If you’re running your hotel efficiently, and reducing your resource consumption efficiently, you can save a lot of money. We need to keep stressing this.”

As well as not costing more, sustainability also builds investment resilience.

Regulation takes the lead in sustainability

Green deniers and laggards will soon be nudged into action by EU regulation. “The new regulation will require a mentality shift”, said zu Hohenlohe. “We will have to change how we consume, travel and how we use products.”

At the heart of Europe’s post-coronavirus recovery plan is the European Green Deal, unveiled last December as a road map to making Europe the world’s first carbon neutral continent by 2050.

At the centre of the Green Deal is the Circular Economy Action Plan, designed to cover the entire life cycle of products; its aim is to ensure that resources used are kept within the EU economy for as long as possible.

The hospitality sector stands to play a very important role in the success of the Green Deal – zu Hohenlohe, Considerate Group

“The hospitality sector stands to play a very important role in the success of the Green Deal even though EU regulations themselves may not place direct obligations on the hospitality sector,” said zu Hohenlohe.

This is for two reasons:

- Buildings account for an estimated 36 per cent of Europe’s greenhouse gas emissions and for 40 per cent of the region’s energy consumption, with hotels being notably higher energy-consuming buildings.

- The hospitality industry is responsible for around 12 per cent of the 88 million tons of food wasted annually in Europe, with food waste producing an estimated 8% of global GHG emissions.

“The European Green Deal places significant focus on both of these factors, among others, which makes it paramount for hotels to act,” said zu Hohenlohe.

What changing regulations mean for hotel investors

The European Union is also revising its framework for non-financial reporting, including the adoption this June of the Taxonomy Regulation, designed to create a “green list” classifying sustainable economic activities.

Rosa Brand, principal of KKR – the global investment firm, which earlier this year closed a US$1.3bn global impact fund, and manages a total of US$207bn – said until now buying a “standard stock” had been about: “Do I leave the [asset]as it is, and run it inefficiently, or do I invest a significant amount of money to improve it?”

“We will be left without a buyer at the end of the investment period if there’s a box that we cannot tick … That has a huge impact” – Rosa Brand, KKR

This new regulatory world has a massive impact on underwriting, says Brand. “We are in the business of creating product for investors who want to own assets for 10 or 15 years, and if there’s a box that we cannot tick in the underwriting we will be left without a buyer at the end of this period. That has a huge impact.”

Sustainability helps corporate clients meet their ESG targets

The pressure to be sustainable is coming not just from new regulation, but also from corporate clients of hotels. “The more companies sign up to ESG, the more the hotels will have to deliver,” said zu Hohenlohe.

“There is very much a profitable upside to focussing on environment and sustainability. We are testament to that” – Josh Littman, SH Hotels & Resorts

Her comments were echoed by Josh Littman, vice-president for development in Europe at SH Hotels & Resorts, an affiliate of global private investment firm Starwood Capital Group.

Because of their focus on the environment and sustainability, SH Hotels & Resorts had successfully captured corporate demand as an event destination, said Littman, especially for their growing eco-luxury 1 Hotel brand, which has 12 new properties in the pipeline, including in London Mayfair and Paris.

“For those who care, the evidence is there, the data is there, the performance is there, the tech is there and it is only going to get more and more pronounced” – Josh Littman, SH Hotels & Resorts

“There is very much a profitable upside to focussing on environment and sustainability. We are testament to that,” said Littman. “The lead time may be a bit longer, but on the flip side you generate more value for a similar level of cost – or, at worst, you’re net even on cost.

“For those who care, the evidence is there, the data is there, the performance is there, the tech is there and it is only going to get more and more pronounced.”

Regulation puts the focus on sustainability for real estate investors

Deka Immobilien is one of Europe’s top real estate fund managers, with a real estate portfolio of around €45bn of which some €4bn is invested in 70 hotels across Europe and the US.

“Sustainability has been on the agenda for years. Our focus has been more on investing in certified core assets with a good return,” said Frank Hildwein, head of hotel acquisitions at Deka Immobilien.

“To further reduce our carbon footprint we will have to work hard and to work closely with our hotel operators” – Frank Hildwein, Deka Immobilien

“Certifications such as BREEAM and LEED were part of our investment process,” Hildwein continued, “but in order to further reduce our carbon footprint we will have to work hard and to work closely with our hotel operators to ensure ESG strategies will be implemented in the day-to-day hotel management. It is going to be a completely new focus for us.”

“To further reduce our carbon footprint we will have to work hard and to work closely with our hotel operators” – Hildwein

The change in Deka’s position on sustainability comes from stronger demand from retail and institutional investors for sustainable institutional products and also from new requirements for ESG ratings from the EU.

With reference to the rise in travellers seeking out ‘guilt-free’ stays, Hildwein commented: “Those eco-tourists are probably the same people as those investing in ESG funds, so now they will have a sustainable hotel and a sustainable fund.”

How to measure sustainability in hotels

There are around 200 global, regional and local sustainability certification programmes specialising just in the hospitality sector, said zu Hohenlohe.

In addition, for buildings, BREEAM is widely used, with BREEAM In-Use Version 6 – launched this May – placing more emphasis on health and wellbeing.

It is important to note that these certifications complement (rather than replace) operators’ and investors’ own corporate sustainability policies and frameworks, says the Considerate Group in a separate webinar about certification.

With such a diversity of certification programmes, measuring ESG is not easy – whether on the operations side or the investor, fund management side.

For KKR, Brand said that they looked to be as consistent as possible, but given the huge variety of assets in which they invested it was “very tricky to find criteria and KPIs that are consistently applied across all classes”.

KKR takes a tailored approach: the investment firm comes up with a list of ESG criteria for each asset and asset class, and where they think they can make an impact over their investment period. As it relates to KKR’s European real estate portfolio, this is then incorporated into the asset management plan. KKR then checks in with the operator every quarter to see that the ESG criteria are being met.

“We are always putting as much pressure as we can on the operating partner, but ultimately the responsibility of executing the ESG criteria lies with them,” said Brand, who added that ideally the way contracts are drawn up should change, so as to give more power to the investor to ensure that the criteria are met.

“The bigger holistic picture starts with having a sustainability strategy, both qualitative and quantitative” – Littman, SH Hotels & Resorts

From an operator perspective, Littman said there was a “bigger holistic picture” in terms of measurement. “This starts with having a sustainability strategy, both qualitative and quantitative,” he said.

For SH Hotels & Resorts, their sustainability strategy also covers, for example, criteria such as employee retention and engagement, as well as ways for guests to offset the carbon footprint from their stay – all measurable criteria.

“When you look at the quantitative and qualitative side to [hotel management], it is pretty clear which groups are more serious about it than others, and which are dipping their toes in the water,” said Littman.

Soon, there will not be much choice… everyone will have to jump in and swim. Green is good for everyone, and profitable – it’s just about changing mindsets and habits.