Resurgent Asia

Hong Kong became the number one destination or capital within Asia during the first half of 2017 and it became one of the largest exporters of real estate investment capital during the same period.

As we gather again in Hong Kong for MIPIM Asia there is a shift of momentum towards Asian real estate markets and at the same time Asian investors are consolidating their position as the top source of cross-border investment capital.

Across the Asia Pacific region, investment activity in Hong Kong, China and Singapore shone in the second quarter of 2017, offsetting weaker deal volumes in Australia and Japan. Hong Kong became the number one city market in the region, nudging aside Tokyo for the first time.

Mainland China claimed the title as Asia Pacific’s largest country market for income-producing assets in the second quarter. This is a significant change and illustrates that China is now a destination for core fund capital, rather than merely a value-add or opportunistic development play.

China registered $14.5 billion of income-producing transactions in the first half of 2017, an 11% increase from a year earlier. Investment flowed to Shanghai and Beijing and to Tier 2 cities such as Guangzhou and Wuhan, propelling these two markets up the rankings of APAC’s top investment destinations.

Chinese capital continued to flow into Asia Pacific real estate, despite news about changes to capital regulations. Chinese investors deployed $9.5 billion in the region in the first half of 2017, a 46% YOY increase. Hong Kong was the fastest-growing net recipient of the capital.

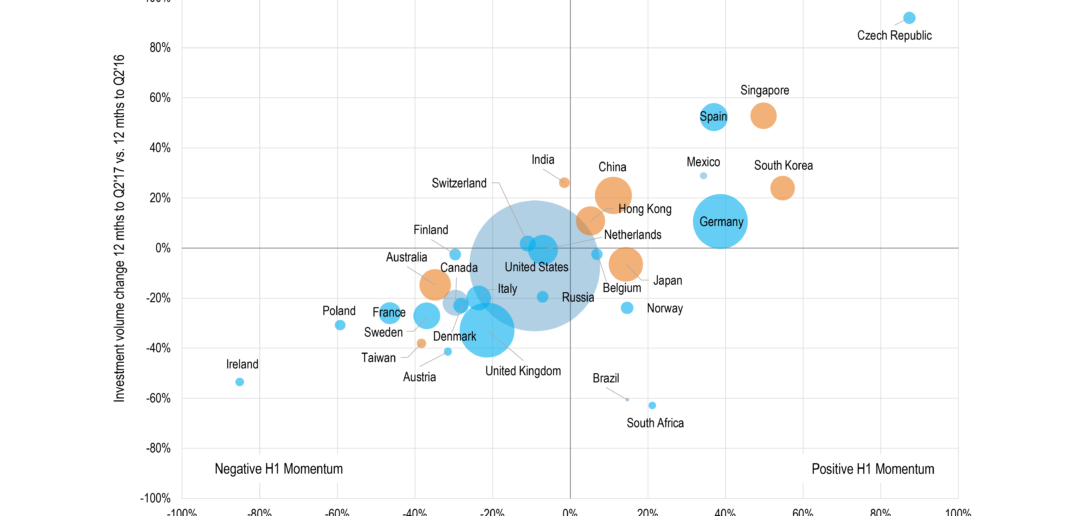

Globally, momentum appears to have shifted towards the East with Asian markets typically showing growth on the half year and last 12 months (see chart). The majority of Western countries are trending towards the bottom left of the chart which indicates a general slowing of momentum.

After the Global Financial Crisis, European and North American markets had lost almost half of their value. While Asian markets escaped much of the downturn it meant the most attractively-priced real estate markets have been in the West. Recent rapid pricing recovery now sees Asian markets on a level playing field with the West and so investors are reevaluating opportunities across the region, resulting in positive investment momentum.

Asian investors, meanwhile, accounted for 45% of global cross-border flows in the second quarter of 2017, surpassing North American investors on 36%. Asia-based investors in Q2 placed the largest amount of capital in Europe yet recorded by RCA. On a rolling 12-month period basis Asian investors comprised a 40% share of global cross-border capital flows, the same proportion as North American investors. Looking at the pipeline pending deals by Asian investors, we expect them to end the full year as the number one source.

Asian buyers represented three of the top five cross-border trade routes in the first half of 2017, with Chinese and Singaporean investors placing $8.5 billion in the U.S. Hong Kong investors were a key group of investors supporting the Central London market, placing $3.1 billion, a 100% increase in activity versus the same period in 2016. Several new cross-border new routes emerged in the first half: South Korean investors entered the top 10 trade routes, placing $1.6 billion in Germany, while China has also expanded its activity to include Denmark for the first time.

Asian investors have played a key role in keeping European cap rates low. Since 2013 they have bought real estate yields, on average, 100 bps less than European cross-border investors and 150 bps less than U.S. firms. This is a risk that Western commentators are watching carefully – with domestic players reducing activity, Asian investors are providing vital market liquidity and price support. I will listen carefully at MIPIM Asia for any sign that this activity will wane in the near term.

—————————————–

About Real Capital Analytics

Real Capital Analytics, Inc. (RCA) is the authority on the deals, the players and the trends that drive the CRE investment markets.

The most active investors, lenders, brokers and advisors depend on RCA’s unique insight to formulate their strategies, source new opportunities, and execute their deals. RCA has earned a reputation of having the most timely and reliable transaction data available. RCA publishes the series of widely-read Capital Trends reports (Global, US, Europe and Asia Pacific) along with the RCA Insights blog – all of which are frequently quoted in industry news and academic research. Learn more at rcanalytics.com.

Links:

– RCA Insights blog – https://www.rcanalytics.com/rca-insights/

– Real Capital Analytics – https://www.rcanalytics.com/