Above: The China Investment Outlook panel, with Natalie Breen (Norton Rose Fulbright); Neil Brookes (Knight Frank), Derek Cheung (New Century REIT) & Jean-Francois Dufour (Montsalvy-Consulting).

For those with interests in the future of Asian investments and real estate, MIPIM’s Pan-Asian Panel (with Gary Hollis, Cushman & Wakefield; Victor Lor, GSA Asia Pacific Investment Management; Nicholas Loup, Dymon Asia Real Estate & Skip Schwartz (Heitman – Private Equity Asia-Pacific) and China Investment Outlook (speakers listed above) delivered fruitful insights into the upcoming future potentials. Both workshops showcased a panel of industry experts willing to discuss the opportunities and challenges in the Asia region, as well as, some of the structural and investment shifts within the Chinese economy.

Setting the Stage

To set the stage, both the Asian and Chinese markets are extremely large and complicated. Altogether Asia comprises 48 different countries, houses 4.5 billion people, and is home to some of the largest development projects seen over the last year. Nicholas Loup (Dymon) mentioned that “US investors look for opportunistic [real estate investments], but many Asian major cities are now core. This is where the global growth will be the next ten years”. Skip Schwartz (Heitman) would also add Sydney and Melbourne to the core Asian markets, alongside those of Tokyo, Shanghai, Bejing, Jakarta, Hong Kong and Singapore. The reasoning behind this is that that Australian markets are more transparent, and have better risk adjusted returns.

Recent headlines would suggest growing concerns over the implications behind the slowed growth in the Chinese economy, which is the largest in the Asian region. Victor Lor (GSA Asia Pacific Investment Management) noted that news headlines about an economic slowdown in China are misleading. He explained that past double digit growth in China has been driven by government investment. The +/- 6% growth, China is currently experiencing, is now less driven by government pushed growth and more private market, so we should not view 6.5% to 7.0% as a decline, as much as a private replacement. This economic shift, to a consumer driven model, will ultimately lead to an overall sustainable long-term annual growth.

Structural Changes in China

Overall, the Pan-Asian panel highlighted the positive attributes for investing in the Asian the region. However Jean-Francois Dufour (Montsalvy-Consulting) brought attention to impacting structural changes  taking place in China, which can change investor risks and decisions. Currently, the Communist Party of China (CPC) is in the midst of its 5-year plan for 2016-to-2020. In it, CPC brings attention to two major points that will have the most impactful change.

taking place in China, which can change investor risks and decisions. Currently, the Communist Party of China (CPC) is in the midst of its 5-year plan for 2016-to-2020. In it, CPC brings attention to two major points that will have the most impactful change.

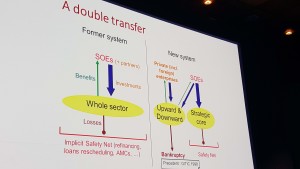

First, Greater opportunities in China will come with a greater risk. Under the Former System, the Chinese government served as a backstop, providing a certain amount of governmental relief ensuing deals would work. Moving forward, China is expected to transition to a  New System of less government interventions. Ultimately, Private Foreign Enterprises can expect no “Safety Net” to downside risks. Secondly, provinces will gain greater influence in regional decisions as China seeks to decentralise its decision-making to the provinces.

New System of less government interventions. Ultimately, Private Foreign Enterprises can expect no “Safety Net” to downside risks. Secondly, provinces will gain greater influence in regional decisions as China seeks to decentralise its decision-making to the provinces.

Best Asset Classes for Investing

The office and residential markets remain strong suggesting the Chinese economy is still robust. Victor Lor (GSA Asia Pacific Investment Management) touched upon some of the difficulties investing in multifamily aside from student accommodation. He noted that student housing for international students works well, just as international office buildings might have worked well in the past. Skip Schwartz (Heitman) saw potential in self-storage, as over the next several years over 100 million people are anticipated to move into cities. Lastly, Neil Brookes (Knight Frank) saw potential in the industrial sector, as e-commerce starts to gain popularity in the Asian markets.

What About Japan?

Skip Schwartz (Heitman) says fundamental drivers in Japan remain strong. « We divide the country into Tokyo and every place else. A 2% growth rate is not great, but then they are not adding supply so fast”. Tokyo is a good long term destination for real estate across asset classes to capitalize on strong inward and outward demand. Nick Loup (Dymon) suggested Japan is a safe haven for funds, and with London being affected by the risk of Brexit, Tokyo looks like a good substitute for safe haven funds. Investors should perceive Japan to be a successful market for the next 20 years. It is broad, deep, and stable with a lot of value add opportunities.

Moving forward, it doesn’t appear as though investment in Asia is changing, but rather the expectations of those investments. Look to Asia for a strong investment opportunity over the next 20-years as major Asian cities have now become core real estate

This is the first in a series of posts from MIPIM 2016 by students of San Diego University. It was co-authored by Dr. Norm Miller, Drew Ector and Michelle Muniz. More soon: meanwhile follow them all on Twitter here!