Seven years after the Global Financial Crisis distressed real estate markets, we still find ourselves in a climate of relaxed monetary policies in the US, Europe, and Japan administered in the form of quantitative easing and low interest rates. In the wake of a severely depressed market, some investors turned to investing in emerging-market economies, new urban developments, and distressed commercial real estate assets.

A new era, in the global real estate market, has emerged from low interest rates and rising values providing investors with uncharacteristic liquidity and plenty of capital known as “dry powder”. Stock market volatility suggests lots of economic jitters. But at the core, macro-economic and real estate fundamentals appear to be sound, and the 2016 outlook seems to be far more positive than most would believe.

PRIVATE EQUITY ON THE MOVE

Growing Liquidity

The financial crisis has produced not only an increasingly mature real estate fund market but also a more educated investor class, which has grown more comfortable with real estate investments in the secondary market. In 2015, real estate managers sought to create new opportunities through consolidation and an expanded secondary market. Alternative investment fund limited partnership interests, are specialized funds, which seek to purchase existing limited partner positions in private equity funds.

Having grown in both size and number, throughout the year, these specialized funds provide limited partners with increased liquidity, and offer a unique buying opportunity for investors. An article in Pensions & Investments titled Managers snap up market-battered REITs indicated that “The secondary market for real estate investments, which grew 30% in 2014 after years of being nearly dormant, is poised to grow 45% this year to up to $7 billion. A key driver for this is that there are only a handful of buyers, they have or are raising substantial amounts… coupled with the fact that there are a limited number of large portfolios for sale, has pushed prices up. And rising prices are inducing other asset owners to return to the market.”

A new product evolution in secondary market, as described in EY Global Market Outlook 2016, consisted of “the recent launch of new vehicles dedicated to acquiring stakes in real estate management companies [they]are providing new opportunities for increased liquidity, growth and access to a broader array of capital services”. Look to see these types of transactions continue in 2016.

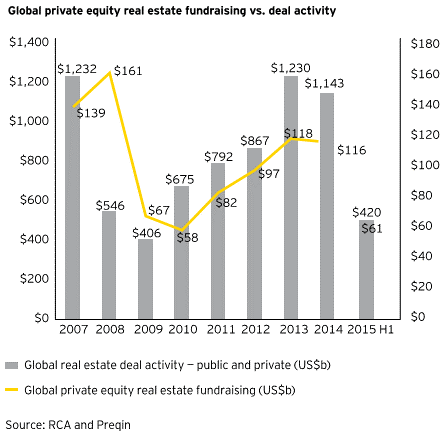

Dry Powder

More so now than in the past, “Dry Powder” (highly-liquid securities considered to be cash-like) has increasingly become a major influencing factor in how private equity real estate managers seek to provide yield to their investors. The Pensions & Investments article Managers snap up market-battered REITs reports that, as of June 30, “managers of real estate equity held a record total of $249 billion in unspent capital commitments… which has not been easy to invest in light of increased competition and rising property prices.”

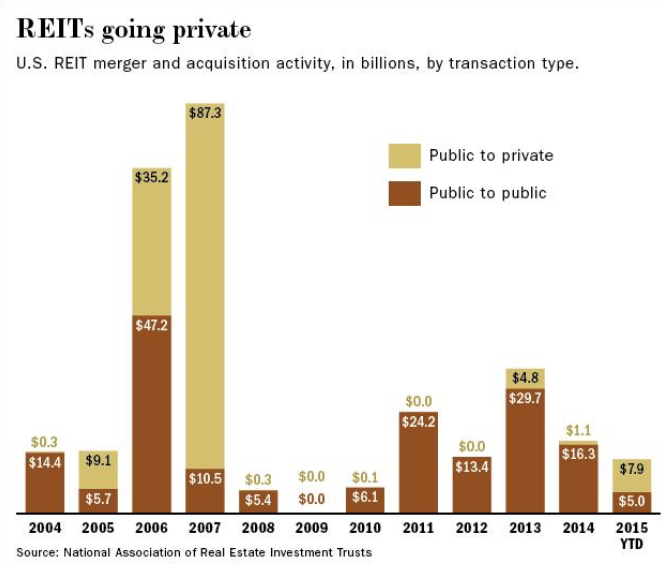

As a result, many of them are looking to REIT privatizations in order to profit from mispricing in the market. “Flush with cash, real estate managers are buying up real estate investment trusts to take advantage of the gap between public and private valuations… REIT share prices have suffered this year, trading roughly 15% below net asset value after trading at a premium last year” (Managers snap up market-battered REITs). If this is true REITs should be selling some assets and buying their own stock back, although they may face internal conflicts in laying off asset managers.

With the arbitrage gains from REIT privatizations and the attractive pricing sellers are able to achieve in the current market, expect public-to-private activity in the real estate sector to be a trend that continues in 2016 (EY Global Market Outlook 2016).

GLOBAL ECONOMIC INFLUENCES ON THE FLOW OF INVESTMENT

The amount of government regulation can have a major influence on global capital flows. Changes to regulation, such as those proposed to the U.S. Foreign Investment in Real Property Tax Act (FIRPTA) could lead to a dramatic increases in foreign real estate investment in larger U.S. cities. Currently, foreign investors account for just 17% of the U.S. commercial market – considerably lower than the U.K. and Europe (around 50% and 60% respectively) (Newmark Grubb Knight Frank). If enacted, these reforms would lift previous restrictions on the amount of dollars foreign pension funds could invest in U.S. real estate.

International capital flows, particularly those across regions, have an importance over and above their proportion of transactions. They tend to be concentrated in key cities, and are watched as an indicator of the overall health of the property investment market and serve as a pricing benchmark for other, less liquid markets (CBRE Global Outlook 2016). The events in 2015 have set the stage for numerous changes in the patterns of cross-regional investment, which are anticipated to have additional fluctuations in the flow of real estate investment. Among these changes, slowing growth in China is the biggest unknown in the global economy, and will have a substantial impact on the economic growth of the Asia Pacific region. However, pension funds and sovereign wealth funds from Singapore, Taiwan, and Japan are anticipated to increase their overseas acquisitions in core real estate assets.

Overall, the expectation is that global real estate investment will increase by 4% in 2016 in U.S. currency terms, and continue to grow further in 2017 and 2018, albeit at a slower rate (CBRE Global Outlook 2016).

CONCLUSION

Global economic trends remain a concern for all investors. Interest rates seem to be slowly rising in the U.S. and the U.K. The Chinese economy is decelerating, and there will likely be a financial crisis in one or more emerging economies related to the challenges of repaying dollar-denominated debt (CBRE Global Outlook 2016). Amid these obstacles, global commercial real estate investment activity will remain robust at least through 2016.

Interested in the latest real estate news & trends? Attend MIPIM 2016! Click here to register!