With the arrival of a new year providing the opportunity of a clean sheet to re-evaluate the next 12 months, global investment manager Nuveen Real Estate has identified five key themes for 2021 – and beyond.

The global investment manager believes that the five themes that they have identified – and outlined in Outlook for Real Estate: Five Themes for 2021 – will lead to a reconfiguration of institutional real estate portfolios by 2030, if not sooner.

MIPIM World Blog dipped into the report and then caught up with Stefan Wundrak, head of European Research at Nuveen, to ask a few questions.

Stefan Wundrak

‘Awash With Cash’ – Waiting for the right opportunities

This is the first of the five themes.

Authorities around the world have created a “low-rate, easy-money environment”, says the report, after responding quickly to the effects of the Covid lockdowns.

Given that previous bouts of quantitative easing (in the global financial crisis of 2008 and the eurozone crisis) saw yields rising, there is nothing to discount the same will happen this time, which in turn will attract investment into real estate, says Nuveen.

Currently there is a supply lag [for last-mile logistics, data centres and residential]and investors may need to allocate capital elsewhere until these opportunities become more readily available – Stefan Wundrak, Nuveen

But isn’t there already a lot of money looking for opportunities in real estate? “There is plenty of capital available to allocate to real estate,” adds Stefan Wundrak, head of European Research, Nuveen Real Estate. “However these aren’t necessarily the opportunities that investors are currently looking for. Investors could plough money into shopping centres, for example, but understandably that is not high on the agenda currently.

“We believe the most compelling assets of the future are last-mile logistics, data centres and residential, but currently there is a supply lag and investors may need to allocate capital elsewhere until these opportunities become more readily available.”

‘Rethinking Suburban Centres & Suburban Life’

Theme No 2. In the US, the flight to suburbia and sunbelt cities will fuel demand for alternative housing, such as single-family units and manufactured housing, predicts Nuveen.

In Europe and Asia, the “outcomes will be more varied, driven by regional and national differences, such as language, culture, planning and transport”. The push will come from the resurgence in second-tier cities and towns, says the report.

Softer factors, such as wellbeing, culture and leisure can all help to make offices more attractive – Stefan Wundrak, Nuveen

Expect to see factors such as wellbeing, culture and leisure to play an even greater role than before. Wundrak explains: “There is not much point going into an office to just sit at a desk all day.

“For offices to add value they need to help workers be productive while in the office, otherwise they could just work from home and save the commuting time. That’s why the softer factors, such as wellbeing, culture and leisure can all help to make offices more attractive and as a result more productive.”

‘Fast Forward to the Future’ – Munich, Edinburgh, Lyon, for example

The future, shaped by technology and demographics, was already beginning to happen before Covid. When it comes to the return to the office, Nuveen believes that demographics and infrastructure play a key role.

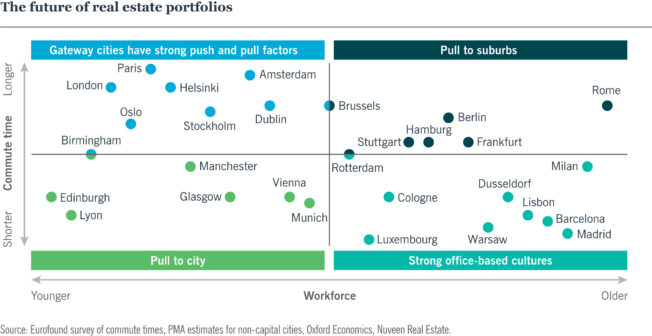

Wundrak explains: “If you look at the bottom left quadrant cities on the graph below, these are the locations that we believe are most likely to return to the office sooner.

“Generally these are more compact cities, with shorter commute times and with a young, dynamic population, such as Munich, Edinburgh and Lyon.”

INFLUENCES ON FUTURE HOME WORKING

‘Winners & Losers’ – a K-shaped recovery

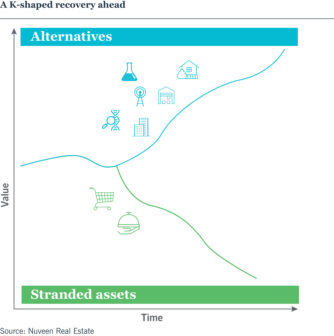

For theme 4, Nuveen sees a K-shaped recovery in real estate. Few assets will be in the middle ground, as values and rents fall for retail and hospitality, and rise for alternatives such as life sciences, medical offices, self-storage, single-family housing, data centres and mobile towers.

The wide range of opportunity and outcomes for real estate reinforces the need for diversification across property types which should spur the increased allocation to alternative property types – says Nuveen.

Disruptive technologies, such as driverless cars and innovations in delivery and food production, also present opportunities, says the report.

We asked Wundrak to expand. “City centres have changed the way parcels are delivered to consumers, to address issues of road congestion,” he explains. “For example, many operators, including Amazon in the City of London, have moved to smaller hubs located closer to households, or office districts, so that last-mile delivery can be fulfilled by bike.”

[Urban farming] presents an opportunity to convert unused space, for example in shopping centres or basements – Stefan Wundrak, Nuveen

With regards to food production, Wundrak adds: “Controlled environment agriculture, indoor farming, rooftop farming and hydroponic systems combine farming with real estate, so that production is closer to where it is consumed. This presents an opportunity to convert unused space, for example in shopping centres or basements. Growing Underground is an example in the UK, where a disused tunnel is being used to grow lettuce.”

‘Climate Change’ – Short, medium & long-term consequences

The last of the five themes, and the theme with ramifications for real estate in the short, medium and long term is climate change.

Despite legislation, extreme events such as floods and wildfires, and more slow-onset processes such as droughts, heat and rising sea-levels, will continue to present investors with a range of scenarios and risks to consider, says Nuveen.

“We believe responsible investing will no longer be considered an additional, complementary strategy but integrated within traditional investment analysis and management,” says the report

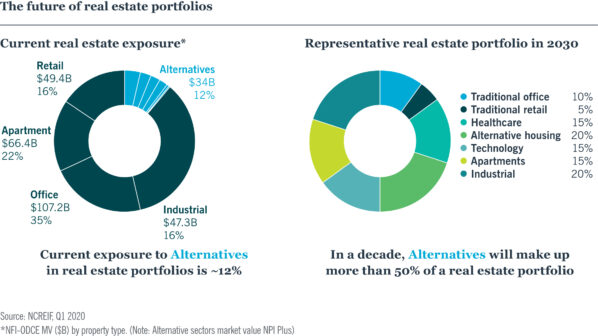

Alternatives set to account for over half of typical portfolio

The Nuveen report Outlook for Real Estate: Five Themes for 2021 also looks at the likely future composition of real estate portfolios.

Expect a lot of sector rotation, in the US, Europe and Asia, as trends are shaped in particular by demographics, technology and sustainability – Nuveen.

THE FUTURE OF REAL ESTATE PORTFOLIOS

In the run-up to the start of the 2020s, the rise of logistics and residential sectors, as well as alternatives, was becoming clear.

Nuveen expects that the target for alternatives, in a typical real estate portfolio, will grow from the present figure of around 12% to more than 50%.

Let’s welcome in 2021!

You may also be interested in the MIPIM World podcast about The Future of UK Real Estate with Kelly Cleveland, head of investment at British Land, the UK real estate investment trust. “We are seeing signs of light in the London [office]investment market… as large prime assets trade at near pre-Covid levels,” says Cleveland in the podcast.

Top Image: Getty Images – SasinParaksa