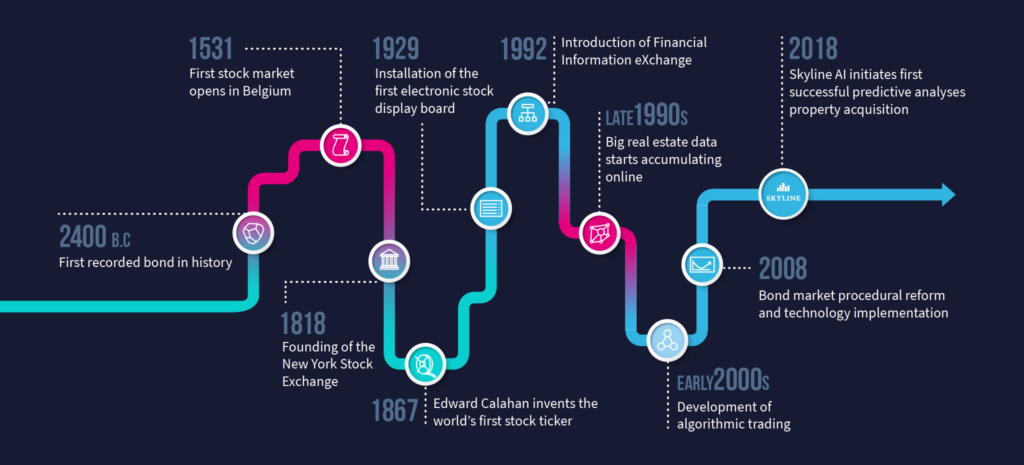

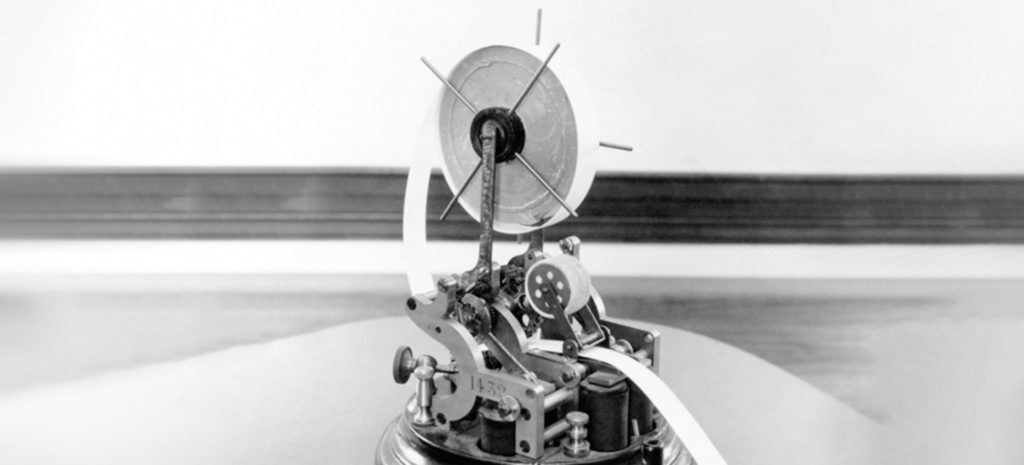

In 1867, Edward Calahan invented the world’s first stock ticker. His device used telegraph technology to transmit real time stock quotes emanating from the New York Stock Exchange to any other portal nationwide – enabling traders everywhere to engage with the NYSE for the first time and planting the seeds for a globally accessible stock market.

Today, almost no industry has emerged unscathed through decades of sweeping tech-based overhauls, and capital and investment markets are no exception. In an exciting ongoing progression, artificial intelligence, predictive analytics, and machine learning are fundamentally changing how investments are identified, analyzed, and executed – with each asset class moving at its own pace.

Even in real estate, traditionally the slowest to adapt to new technologies, the winds of change are blowing. Using technology-based advancements in capital markets as a precedent, let’s explore what the future of real estate investment is shaping up to look like.

The State of Commercial Real Estate

In the world of real estate investment, personal experience, salesmanship, and relationships have long been regarded as cornerstones of the business – which explains the reluctance of RE professionals to introduce machines to the mix. But due to record dry powder levels and shrinking profit margins, the stakes are high – and there’s a lot to be gained by phasing in cutting-edge technology, especially artificial intelligence and machine learning.

AI’s Broad Potential

Real estate asset appraisal traditionally depends on comparisons with similar assets, current trends, and contextual data from the greater market. With a huge and growing range of metrics to consider – macroeconomic data, MSA levels, neighborhood quality, asset levels, market trends, and more – AI’s ability to make sense of huge swathes of data can hardly be ignored.

This vastly expanded data pool, when taking into account new sources like Street View images, social media, cellular data, satellite imagery, clickstream data, advertising campaigns, news trends, topological maps, and geospatial data, yields much more accurate predictions than ever before possible. Culled from decades of aggregated data across the entire US, including property trends, anomalies, and a host of other valuable illuminations, these predictions help guide investors confidently regarding where and when to invest, unload, or shift management tactics.

In the past, real estate professionals carried out data-generated comparisons using paper sheets and then Excel files, based on their market experience and the relatively limited available information. Hybridizing the expertise of human asset managers with the power of AI will deliver a range of insights not previously possible, and with it, an unassailable competitive advantage. And with AI, the whole package can be analyzed in minutes – not days or weeks. Yet, with all this potential, the commercial real estate market is still only beginning to shift.

Comparing Investment Innovation Tools from Other Markets

To really understand tech’s capabilities for the relatively new CRE frontier, it’s worthwhile to explore the impact it’s had on the stock and bond markets. As they continue to do for capital markets, AI, data analytics, and machine learning are beginning to do for commercial real estate, by applying tools of unprecedented efficiency and accuracy to the investor’s arsenal – deepening their market understanding and creating huge new value opportunities.

A Brief History of Capital Investment Technology

Bedrock financial markets have a fascinating history of tech-based initiatives, some implemented only reluctantly, some welcomed with open arms – but all ultimately responsible for deeply pivotal overhauls which continue to enhance trade, investment, and profit margins to this day.

Today, computer-generated trades, robo-advisors, and high-frequency trading are established norms of the stock market – the first in the investments sector to usher in the tech invasion. The bond market, however, known for its spirit of conservatism, has been slower to evolve – but change is happening there too, albeit at a more cautious pace. Overall, advanced technologies have reached the point where restructuring venerated investment models across a variety of asset classes is now just common sense.

The Stock Market’s Expedited Evolution

Integrating technology into the stock market’s core procedures was a fairly seamless transition, because the stock trading business has always relied on two things: cross-network communication, and rapid trade execution. Introducing technology enhancing these processes was keenly welcomed from the get-go, and continues to be of high value to stock market operations and trader efficiency alike.

The tech-based stock market overhaul had a number of significant milestones. In the early 1970s, NASDAQ became the world’s first electronic stock market, gradually reducing the centrality of color-jacketed pit traders at a physical location. Electronic trading became the global norm, and was eventually followed by the introduction of algorithmic trading, which again changed the game by enabling automated high-frequency trading (HFT); no human monitoring required. The third phase is currently ongoing. Artificial intelligence and machine learning are becoming capable of analyzing huge data sets, extracting patterns and pinpointing value with incredible speed. The reconstructive potential of this phase may end up overshadowing previous phases in its sheer core market impact – so it’s no surprise that investment and capital-based companies are prioritizing the large scale recruitment of top AI and data science professionals.

Today, quantitative trading is lessening the margin of human error even more. With an almost $1 trillion market share, quants specialize in high-volume trading, using machine learning to avoid the pitfalls of human biases.

Slow but Steady: The Bond Moves Beyond

Unlike its stock market cousin, the bond market has lagged in its integration of innovative technology – but even this three-piece-suit bastion of traditionalism is coming around. Historically, bonds were never exchanged boisterously on an open trading floor – they were an insider’s game, changing hands largely via telephone within an elite community. But as bond markets declined in recent years, the industry found itself open to new directions, and today, bond trading has become democratized – electronically accessible to anyone. Artificial intelligence technology is affecting core operations in the bond world too: “Abbie”, the automated trader built by New York investment firm AllianceBernstein, now handles 35% of the group’s bond exchanges – trades worth almost $19 billion thus far. By automating bond market processes, robots like AllianceBernstein’s Abbie are changing the way bond trading has always been done, contributing hyper-accuracy, access, and opportunity capitalization to a once-stagnating industry.

An example of the first telegraphic stock ticker from 1867, invented by Edward Calahan.

The Real Estate Lesson

History shows that overhauling outdated investment methods and tools with technology is unquestionably advantageous. It’s been almost 150 years since Edward Calahan changed everything with his telegraphic stock ticker. Then, investment processes became more streamlined, accessible, and profit-generating – while still relying on human ingenuity and instinct. Today, data science and technology are changing commercial real estate in much the same way. As time goes on, investors with the agility to embrace the capabilities of machine learning and AI will have a solid competitive advantage in the market, outperforming traditional market benchmarks and ultimately thriving while others perish.

Despite the relatively established methodologies of the CRE investment world, the time has come for a ground-up remodeling. Companies like Skyline AI are already harnessing the awesome power of AI and machine learning, powerfully enhancing the way investments are analyzed and capitalized – bringing greater access, transparency, confidence, and profit to all sides of the equation.

The ultimate goal of AI-driven commercial real estate solutions is not only to empower users with AI capabilities to source deals and underwrite investments, but also to build machines that will use predictive analytics to provide the best deals available with an injective, one-to-one recommendation – in other words, to learn the traits of the best-performing commercial assets, and use them to predict which assets will be the strongest performers in the future.