Science-based targets have helped guide the path for real estate’s sustainability journey. But is the industry reducing emissions quickly enough to meet its commitments and avoid financial and regulatory risks?

To answer this, Measurabl’s data science team conducted a first-of-its-kind, proprietary analysis, leveraging Measurabl Quantum—the world’s largest repository of real estate sustainability data, tracking 273 million MTCO2e across 110,000 properties in 93 countries representing $3T (USD) in AUM.

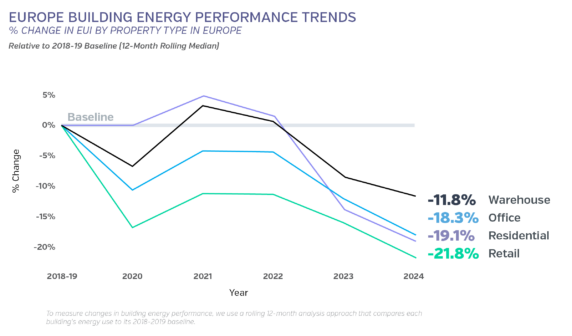

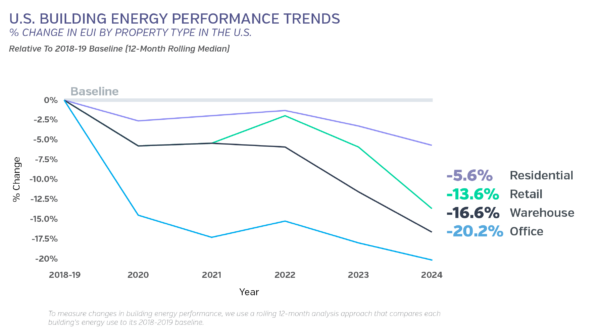

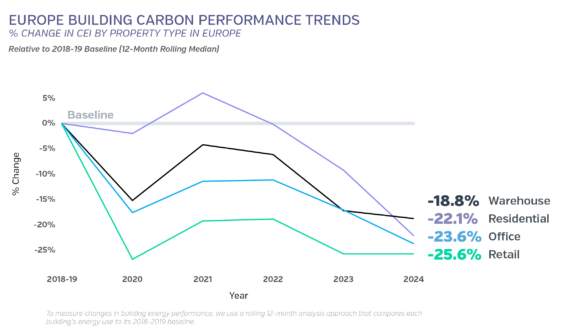

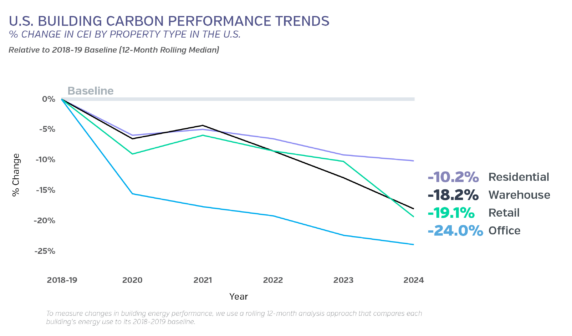

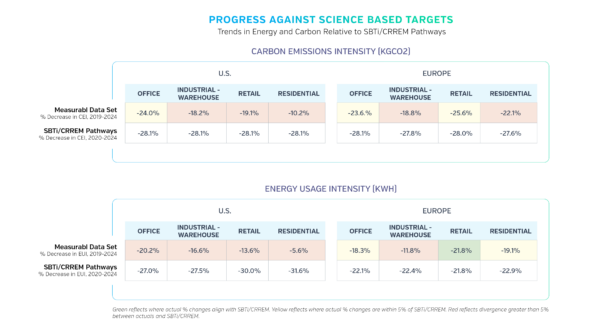

Focusing on four key property types—office, residential, retail, and warehouse—this study offers a data-driven look at sustainability progress in both the U.S. and Europe. We analyzed percentage changes in energy use (EUI) and carbon emissions intensity (CEI) from 2019 through 2024, using a pre-COVID baseline. The findings reveal relative progress for each region over the same time period.

U.S. and Europe Show Consistent Declines in Energy and Carbon Reductions

Offices in both regions show steady, near-parallel reductions. Offices in Europe saw 18.3% reduction in energy, closely trailing a 20.2% drop in the U.S. Similarly, carbon intensity declined by 23.6% in Europe nearly matching the U.S. 24% decrease.

The biggest gap is in residential, where Europe’s 19.1% reduction in energy use outpaces the U.S.’s 5.6%. A similar trend is seen in carbon intensity, with Europe achieving a 22.1% decline compared to 10.2% in the U.S.

Warehouses are the most evenly matched sector between the two regions for reduction in carbon intensity: 18.8% for Europe, versus 18.2% in the U.S. For energy intensity, the U.S. achieved a 16.6% reduction, while Europe followed with an 11.8% decrease.

In the retail sector, energy use in Europe has dropped by 21.8%, compared to 13.6% in the U.S.—a notable gap, but one that suggests the U.S. retail sector is making meaningful strides. The carbon story follows the same pattern: a 25.6% reduction in Europe, versus 19.1% in the U.S.

Understanding Our Approach

What makes this study different?

- Long-Term Trends: Instead of static benchmarks, one-time snapshots, or aggregated annual samples, this study follows each building’s space-level performance for six years (2019-2024), capturing meaningful sustainability trends both pre- and post-COVID.

- Longitudinal Study: Each building is measured against its own 2019 baseline for each year. This approach means we tracked the performance of the same buildings over time, removing biases related to age, size, or use.

- Granular, Meter-Level Data: Unlike other reports that rely on self-reported data, we track energy performance using actual utility meter data from both spaces and buildings, delivering a new level of precision.

- Data Quality & Accuracy: It filters outliers and is adjusted for seasonality. The use of rolling 12-month periods smooths out seasonal fluctuations and temporary anomalies, providing a more accurate reflection of long-term sustainability trends over time.

- Unmatched Breadth: Covering 52 U.S. states and 33 European countries, with 19,927 spaces across 11,992 U.S. buildings and 24,498 spaces within 3,432 European buildings, this study offers a comprehensive view of trends across regions and property types.

The full methodology is available on Measurabl’s website.

Despite varying performance across regions and sectors, the broader trend is clear: progress is happening globally. Even in the wake of COVID, amid turbulence, and against a backdrop of geopolitical disruptions, rising energy costs, and fluctuating interest rates, real estate is advancing toward sustainability. The industry’s response highlights a fundamental shift, with sustainability now viewed as a strategic lever for long-term value creation, not just a compliance issue.

Is Progress Happening Fast Enough?

“Our data shows that energy and carbon reductions are steadily declining across property types in the U.S. and Europe since pre-COVID levels. However, when we compare these rates of decline against those provided by science-based (CRREM) targets, we see that the progress falls far short of what’s needed to meet the Paris Agreement goals and align with a 1.5 degree warming scenario by 2050. Overall, the gap between actual progress and science-based (CRREM) targets is greater in the U.S. than in Europe, where reduction in energy usage is within 5 percentage points of that required by CRREM for three out of four broad property types.”

- Sara Anzinger , SVP of Data Strategy & ESGx

The takeaway? Both regions are making strides, but without a fundamental shift in approach, real estate will fall short of net-zero goals—putting assets at risk of devaluation. With global emissions set to peak by 2035 and energy demand rising 18% by 2050, the industry must act now. The winners will be those who invest in innovation, forge strategic partnerships, and most importantly, use high-quality sustainability data to inform decision making.

Sustainability Is No Longer Just Compliance—It’s a Capital Strategy

Sustainability progress isn’t happening because of policy alone—it’s accelerating because the market demands it.

Even as the SEC’s climate disclosure rule faces delays, 25 U.S. states have reaffirmed their commitment to the Paris Agreement in recent weeks. The real momentum isn’t just coming from mandates—it’s coming from capital markets. Investors, and lenders embedding sustainability into financial decision-making. Lenders are factoring energy efficiency into debt terms. Investors are embedding carbon reduction benchmarks into capital allocation. Tenants are prioritizing high-performance buildings in leasing decisions. Those who can’t quantify and validate their performance will face higher capital costs, weaker demand, and stranded asset risk.

PGGM, one of Europe’s largest pension asset managers, is at the forefront of this shift. Managing over $26.4B billion in real estate investments, PGGM has redefined its investment strategy—prioritizing energy performance over corporate carbon proxies by leveraging one of Measurabl’s data products, ESGx Securities.

“We are moving into what we call ‘3D investing’—where sustainability, risk, and return are equally weighted in investment decisions. However, one of our biggest challenges was getting the granular energy data needed to accurately assess transition risk. Jumping straight to carbon metrics, which many providers do, we lose sight of the original input—energy performance. Real estate is fundamentally about asset-level energy, which Measurabl provides, and that’s where our focus lies.” — Andrea Palmer, Responsible Investment Lead, Global Real Estate Securities, PGGM

Sustainability is no longer a compliance obligation—it’s a business strategy. This is the future of real estate: objective data over vague commitments, asset-level insights over broad corporate disclosures, and verifiable performance over proxies.

Data Is the Catalyst for a Sustainable, Profitable Built Environment

For over a decade, Measurabl has operated on one simple truth: data is the key to real estate’s sustainable future. Today, that’s clearer than ever. The future of real estate is about proving measurable progress, and investment-grade data is key to accelerating it. Yet, despite growing demand for transparency, real estate struggles with fragmented, unreliable data. Many rely on outdated methodologies or incomplete disclosures, creating financial blind spots that hinder transition risk assessment, performance benchmarking, and capital decisions.

Measurabl is changing that.

Our suite of data products, called ESGx (Exchange), raises the standard for energy and carbon transparency, providing the investment-grade data that real estate owners, investors, and lenders need to de-risk portfolios, secure financing, and future-proof portfolios. With asset-level benchmarking, CRREM-aligned performance tracking, and real-time energy and carbon insights, we turn ambition into execution. Our data products include:

- ESGx Benchmarks set a new standard in energy and carbon transparency, offering a comprehensive view of real estate sustainability performance across property types and geographies. Download a free sample report here.

- ESGx Buildings provides the most reliable and timely sustainability data points for asset-level energy consumption and carbon emissions, highlighting the greatest risks and opportunities facing individual properties.

- ESGx Securities delivers standardized, on-demand reports that empower investors and stakeholders to evaluate property-level climate risks and opportunities, all backed by the powerful data of Measurabl Quantum.

- Diligence helps real estate stakeholders make informed decisions by comparing a property’s environmental performance against global, national, and state benchmarks.

Last year, we integrated asset-level ESGx data into the LSEG/FTSE EPRA NAREIT Green and Green Target Index Series, enabling $9 billion in investor capital to track sustainability metrics with precision. Recent demand speaks for itself: in 2024 alone, adoption of Measurabl’s ESGx data solutions grew by 64% year-over-year.

Data is no longer just a tool for measuring sustainability—it’s the catalyst driving it forward. Capital markets are already setting the pace. The only question left: is your progress measurable?

Connect with us today to learn how we can turn data into your competitive edge.